Guide to investing for long-term financial wellness

Investing for the long-term can be one of the best ways to improve your financial wellness, build sustainable wealth, and create the future you want. But a major knowledge gap prevents people from opening retirement accounts, investing in the stock market, or contributing to a 401(k).

According to Standard & Poor’s Global Financial Literacy Survey, the U.S. ranks 14th in global financial literacy skills. This means many Americans don’t understand essential investing concepts, such as numeracy, compounding interest, risk diversification, and interest.

This guide to investing can help bridge that gap. It shares why investing is important, what types of investments are available to you, how to build a diversified investing portfolio, and more.

- What is investing?

- Why is investing important?

- What are different types of investments?

- Alternative investment options

- 5 steps to take before investing

- Which investments are right for me?

- The pros and cons of common investments

- How to start investing

Let’s begin with the fundamentals of investing and how it can improve your financial well-being.

What is investing?

Investing is the intentional act of purchasing assets to generate a profit, grow your net worth, and meet your financial goals. Investments come in many forms, such as stocks, bonds, investment funds, real estate, cryptocurrencies, and artwork.

No matter the method, the ultimate goal of any investment is to make more money than you originally put in. But what does that look like in the real world of financial market investments?

Either you, or someone you pay to manage your investments, will buy stocks, bonds, mutual funds, or alternative assets in hopes that your money will grow over time. How much money you make from investing depends on the market, as well as your risk tolerance, time horizon, investment strategy, and many other factors. The stock market is unpredictable, and even the most qualified stock market experts aren’t always right.

You may be wondering, “If the top money managers don’t always win, why should I invest?”

Think about it like a garden. If you plant rows of vegetables, you won’t get farmer’s market-level greens the next day. The same can be true with investments. Much like gardens, investing takes patience, care, and a long-term mindset as you wait for your financial plan to materialize.

Before going any further, it’s important to understand the difference between trading and investing. Trading is a short-term pursuit of immediate gains, like day-trading stocks on the New York Stock Exchange. On the other hand, investing is the process of building wealth for the long-term.

In our opinion, day trading and speculating aren’t viable ways to build long-term wealth. Instead, we encourage investors to focus on a committed approach of buying, regularly investing in, and holding ownership of a diverse and balanced set of investments for a long period of time.

Why is investing important?

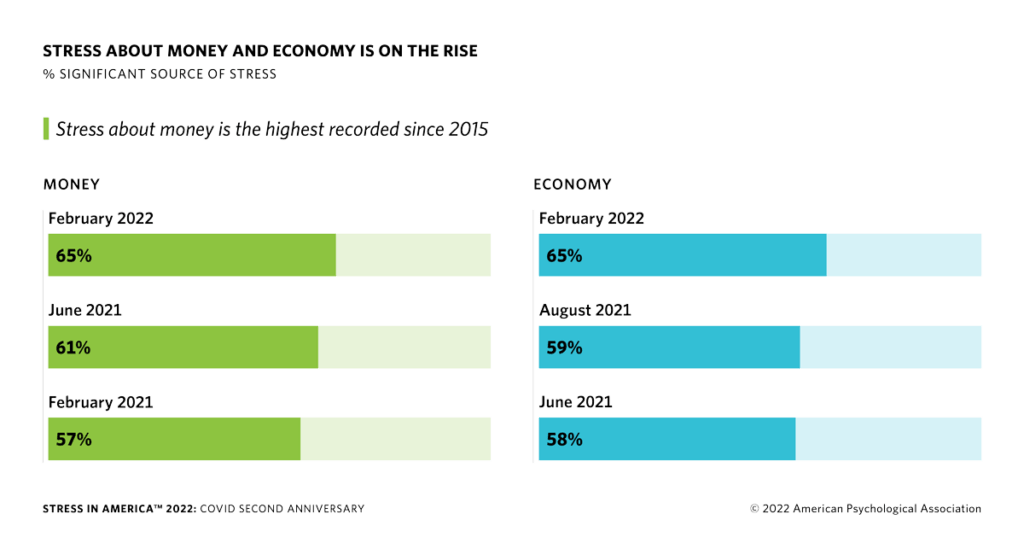

Finances are a major stressor in people’s lives. Research from the American Psychological Association (APA) shows that 65% of adults consider money a source of stress—the highest level since 2015.

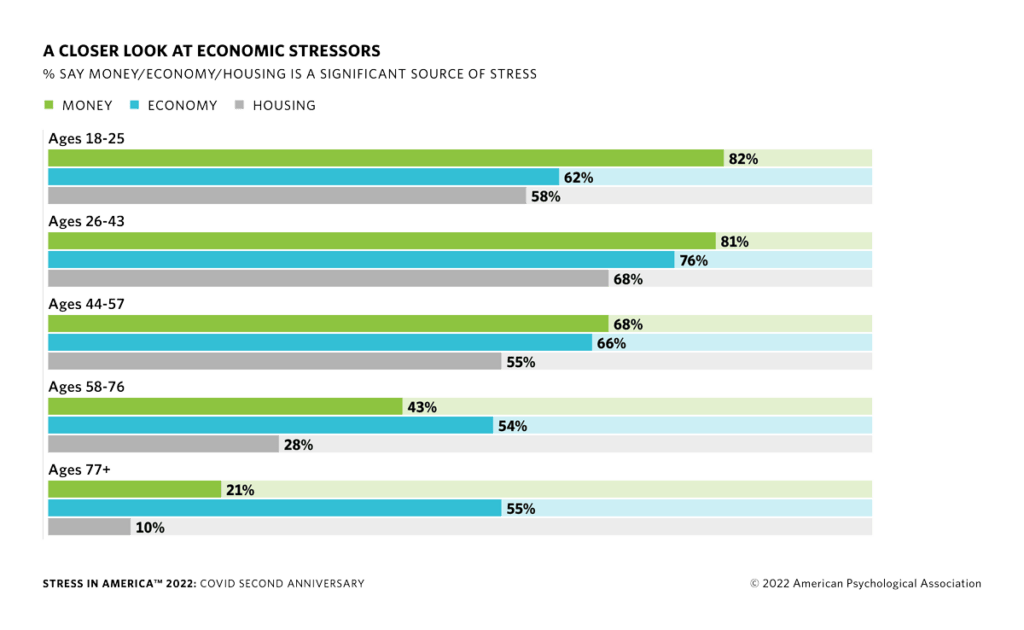

Financial stress affects people across all age groups, with a significant impact on adults between 18-57 years old.

What does investing have to do with this stress? Long-term investing and wealth building could help alleviate stress for all ages and income levels through financial security. It’s possible to develop this security through four key steps:

- Make money. You need a long-term, consistent source of income that supports your future goals so you can invest and save.

- Save money. Once you have a source of income that fits your goals, you’ll want to build up basic savings like an emergency fund.

- Invest money. Once you’ve built an emergency fund (6+ months of basic living expenses), you can start to invest for potential returns. There are several ways to invest, which you’ll learn about further down in this guide.

- Manage money. As you continue your financial wellness journey, you’ll need to manage your money through spending, saving, investing, and borrowing. You could open credit cards, become a homeowner, and go through dozens of other financial changes.

Support your investing strategy with all-in-one digital banking >>

What are the different types of investments?

It’s easy to lump stocks, bonds, and other financial instruments into one vague group. But the types of investments are distinct, so here’s an explanation of each.

- Securities are any financial asset that can be traded. An asset is any valuable good classified as durable or useful over time. This means that it can be used to store value, like a luxury car or a house.

- A stock is a security that represents ownership in a company sold by the firm to an investor or shareholder. The business then uses the money to fund operations, and the investor receives dividends, or fiscal rewards, based on the company’s performance and earnings.

- A bond is a type of debt security where an investor, or creditor, funds someone else’s loan in return for interest or other payments. Unlike a stock, a bond doesn’t represent a stake in a company.

- Mutual funds are a type of investment fund or pooled investment vehicle. Third-party financial managers use money from multiple investors to purchase a range of different security types where they usually charge fees for their work. These securities include stock, hybrid, money market and fixed-income funds.

- Index funds are mutual funds that adhere to predetermined rules, which makes it easier to track specific classes of investments.

- An exchange traded fund, or ETF, is an index fund that gets traded like stocks on exchanges. Theses funds can contain a range of securities and assets.

- Options are instruments based on prospective transactions. These contracts let investors reserve the right to trade in assets at a later date and a given price.

- Retirement accounts, such as IRAs and 401ks, are all examples of a tax-advantaged retirement plan designed to help you prepare for retirement. The account can be tied to a variety of investment vehicles that heighten their value.

- Real estate investments are purchases of tangible land or property, such as personal homes or commercial lots.

- Alternative investment is a general term for investment options that aren’t in the stock, bond or cash category. An example would be investing in a startup as a venture capitalist or getting involved with hedge funds.

- A portfolio is a collection of investment assets. Most people try to structure their portfolios by carefully choosing types of investments that maximize their gains while reducing their risk of losses.

Alternative investment options

Alternative investments, like cryptocurrencies, can be difficult to value and typically come with low liquidity because they’re more difficult to sell. Since most traders and investors are relatively unfamiliar with alternative investments, it is critical to understand the nuances before investing.

Real estate investment trusts

A real estate investment trust (REIT) is a public or private company that owns property to create income. This type of property is usually commercial, and the REIT typically assumes the responsibility for its operations. REITs can specialize in equity ownership or mortgage, and they can be traded on exchanges.

Commodities

A commodity is a service or good whose units are fungible, or interchangeable. In terms of futures contracts, which function similarly to stock options, commodities are typically classified as:

- Soft: Agricultural goods, such as grain

- Hard: Goods that come from mineral exploitation, such as iron ore

- Energy: This includes electricity and fuel sources

Precious metals

Precious metals, such as gold and silver, are hard commodities. Due to their rarity and stringent trading regulations, these alternative investments carry minimal risks. Of course, holding a lot of coins or gold certificates may not be very convenient. But they can balance out portfolios that contain other types of investments for sustained wealth building.

Hedge funds and private equity

A hedge fund is a managed fund that receives capital from institutional investors and those with a high enough net worth to receive special regulatory designations. Private equity investment funds are limited partnerships that specialize in purchasing and restructuring nonpublic enterprises. These types of investments are typically for venture capitalists or the independently wealthy.

Cryptocurrencies

Cryptocurrencies (think, Bitcoin and Ethereum) are digital currencies and a relatively new asset class. Many cryptocurrencies are on a decentralized network powered by blockchain technology. They’re less regulated than traditional stocks or other asset classes and can be a volatile investment. Many investors use crypto to diversify their portfolios.

5 steps to take before investing

You may be eager to invest, but we want to make sure you’re set up for success before getting started. Here are a few steps to help you prepare and define your goals for investing.

1. Establish your goals.

Think about why you want to invest. What are your financial goals? These can include everything from homeownership to a rainy-day fund, travel, retirement, and everything in between.

It’s helpful to make your goals specific and measurable, but some goals require big picture thinking. For these, consider your time horizon: how long do you have until you’d like to achieve it? To think through your goals, check out these tips for planning financial goals.

2. Build a savings strategy.

Having trouble deciding what to save and what to invest? You’re not the only one. This is one of the most frequently asked questions when getting started.

- Start with your emergency fund. Aim to save three to six months of living expenses in case something unexpected happens.

- If you can, try to save 15% of your earnings. A simple way to do this is automatically sending 15% of each paycheck to a savings account.

- Look at your goals. Begin calculating how much you need to hit your unique goals and how much you have each month to invest.

3. Calculate the amount to invest.

Once you know your goals, you can figure out how much to invest. Many investors find it helpful to build a budget. Budgeting helps you stay focused and on track towards your financial goals. Your budget can be a simple spreadsheet or a detailed color-coded masterpiece where you meticulously track each purchase.

Budgeting is essential for several reasons:

- It helps you identify money habits

- It keeps you focused on your goals

- It removes stress of not knowing where your money is going

Learn the fundamentals in our guide to budgeting >>

4. Understand your risk tolerance.

Risk tolerance is defined as an investor’s ability and willingness to withstand volatility in the stock market. For investors who have never weathered a market downturn before, it’s difficult to pinpoint exactly how you will likely react the next time markets take a dive.

The question is: how much are we willing to put on the line to do it? And how much will our emotions rule our decisions if our account value plummets?

Everyone thinks differently when faced with uncertainty. But you can learn more about how you might react by taking a risk tolerance quiz. Make sure to keep outside influence in mind when evaluating how much or little you’re willing to risk. In our social-first world, investing advice is often fueled by the media, financial influencers, and online communities. In a 2021 survey, we found over half of Gen-Z and Millennials have adjusted investments as a result of social media.

Social channels (along with new fintech apps) are teaching and influencing more people to invest than ever before. On the flipside, they also popularize some risky practices like short-term trading and drive groupthink among retail investors.

As you figure out your risk tolerance, remember there is no magic pill or button that will give you the results you want quickly. Instead, reliable plans, habits, and technologies can support your investing goals over time.

5. Learn common investing mistakes.

New investors (and even seasoned ones) make mistakes. Slip-ups could be harmless, but they could also seriously affect your finances. As you start to buy stocks or invest in mutual funds, try to avoid the most common investing mistakes.

- Believing any investment is a sure thing

- Paying too much attention to short-term noise

- Blindly taking advice without doing your own research

Now that you have your goals, risk tolerance, and priorities straight, it’s time to use this guide to investing to learn about your investment options.

Which types of investments are right for me?

The right types of investment match your goals, risk tolerance, and time horizon (how many years you want to invest). No single option is right for everyone. Even though most experts advise investing in fewer risky financial vehicles the older you get, they all have their own takes on the ideal portfolio breakdowns.

The most important things to understand are what you’re investing in and your unique strategy. That means learning how to research stocks, understanding the basics of value investing or dividend investing, and creating goals based on your age.

The pros and cons of common investments

Before you build or refine your portfolio, you’ll want to know more about the different types of investment options.

Stocks

A stock represents ownership in a company. Buying stock gives an investor multiple chances to make money. In addition to being paid annual dividends, you can sell your shares on the stock market. If the value of the stock has increased since you originally purchased it, then you can turn a profit.

It’s important to consider, however, that great returns aren’t always guaranteed for these investment options. With thousands of publicly traded companies selling stock, they are not all going to be success stories.

The performance of a single stock is contingent on the performance of the company and will rise or fall with its success or failure respectively. A single stock is one of the most risk-filled investment choices, so people often need high expected returns to compensate for this risk. Stocks are investments for people with a long-time horizon and high-risk tolerance. Owning multiple stocks diversifies the risk away from any one company, but it doesn’t guarantee a profit.

Want to start investing in stocks? M1’s tools can help investing beginners with options for fractional shares, dividend stocks, and industry-leading automation.

Bonds

Bond investing lets you act as the creditor to companies, governments, and municipalities. Bonds are considered a relatively low-risk investment, but some are riskier than others. For instance, bonds issued by the federal government come with more guarantees, while those from cities and states have less promises. Bonds issued by corporations are typically seen as riskier than those issued by the government, which do not have the same level of creditworthiness as the U.S. Treasury.

One nice thing about these investment options is that they grant you a stable income. This income is derived over a fixed term set at the time of issuance. The term usually corresponds to the loan’s repayment period, but you can bail out at any time. Selling early may mean that you do not recoup your initial principal investment, but since bond profits are related to loan interest rates, it may be the right move if you can find a bond issued at higher rates.

Mutual funds

Mutual funds are ideal for those who want to make money without getting caught up in the details. Instead of having to worry about whether you are picking the right securities, you can choose a fund that groups them together on your behalf.

Since third parties manage most mutual funds, trust is a major issue. Although it is usually easy to find a money manager, choosing one with a track record of generating profitable returns can be trickier. If you have a portfolio full of unique or unconventional assets, then you should consider devising your own custom management strategy.

Index funds

Index funds offer another way to get around the typical intermediary costs. Instead of depending on third-party managers to research and select securities, investors rely on the fact that each index fund follows a particular market index.

A form of passive investing, indexing reduces the expense associated with maintaining portfolio assets. These funds also tend to outperform many mutual fund investments over the long term because there are fewer expenses in researching and trading investments. Interesting fact: Warren Buffett recommended index funds as one of the better retirement investments options.

Exchange Traded Funds (ETFs)

An ETF is a specific kind of security that tries to match the performance of a predetermined indicator, like an index fund. The key distinction is that they offer more flexibility because these exchange traded funds get bought and sold on the stock exchange.

With a mutual fund, transactions are pegged to daily end-of-trading prices. With exchange traded funds, you can capitalize on the fluctuations depending on when you sell. Thanks to automated advisers, these types of investments are more accessible and reliable than they once were.

Stock options

When you purchase a stock option, you’re buying a contract. This contract gives you the right to trade a certain number of stock shares, usually 100, at a specified date and time. This type of investment also lets you choose the price for the transaction, if your trading partner agrees to it.

What’s the point of this complexity? The goal of stock options is to outguess the market or hedge price movements. You either want to buy a stock for less than it’s worth or sell it for more. If things don’t look like they are going to work out, you’re not obligated to complete the deal—although you will lose what you spent on the options contract.

IRAs and 401ks

Investing for retirement is different than other kinds of investment. Long-term portfolio stability is the name of the game here, and you can take advantage of some unique financial vehicles to achieve it:

- An IRA, or individual retirement account, is a good way to plan for the future and capitalize on various benefits. Traditional IRAs let you deduct the contributions from your taxes, and investing in Roth IRAs let you make transactions without incurring tax penalties. To maintain your eligibility for such advantages, you’ll need to stick to a variety of rules for withdrawals and contributions, however.

- A 401k is a form of IRS-recognized pension account where your employer provides or matches your contributions. Since the contributions come from your paycheck before you receive it, you do not pay taxes until you withdraw the money. As with most retirement accounts, you can only withdraw under certain conditions. A host of labyrinthine laws exist, but you might be able to reduce your tax burden by waiting to pay until you are in a lower tax bracket.

Real estate investment and home ownership

Real estate investment options let you put money into stable assets in the hopes they will appreciate over time. For instance, you might invest in a home you plan on occupying until you sell it for a higher price. Or you might invest in a business property and become a residential or commercial landlord.

As with other types of investments, real estate investment comes with unique risks. Events like housing crises and economic downturns can take large amounts out of your cash flow. If you’re running a business, you also have to consider your operating costs.

How to start investing

You have two options when getting started: self-managed investing accounts or professionally managed investing accounts.

- Self-managed accounts: If you want to have control over your accounts, you’re not alone. Be sure to choose an investing platform that saves you time, shares your mindset, and offers you the flexibility you need to manage your money.

- Professionally managed accounts: Taking a hands-off approach and letting a professional manage your investments is a great option for some investors. Some people find that working with a professional keeps them disciplined and gives them peace of mind that their investments are handled the right way. The Securities and Exchange Commission shares sound advice to stay safe while working with an investment professional. You can also see if working with a financial advisor is right for you.

Build your investment portfolio

The platform you choose is where you’ll build your portfolio and refine it over time. As you read more about the companies and assets in which you’re invested, you’ll decide whether certain securities fit your goals, risk tolerance, and time horizon. This will inform you whether you should buy or sell—but the goal is to think about your long-term future.

Considering asset allocation by age means investing more aggressively when you’re younger and being more conservative as you near retirement. Once you choose your platform, it’s time to build your portfolio. There are a few steps to creating an investment portfolio:

- Start by opening an investment account.

- Roll over any old accounts.

- Connect your savings or checking account to the investment account.

- Choose your investments and allocate the money in your portfolio.

- Automate as much as possible for transfers, auto-investing, and savings.

Maintain your investment portfolio

To create and maintain a balanced portfolio, you can diversify your investments according to your objectives and goals. This means reviewing your investments and rebalancing your portfolio as necessary. Many investors do financial checkups quarterly or annually.

With M1, you have a way to easily maintain your portfolio, explore and invest in the companies, sectors, and markets you believe in. The tools are yours to research investment options, build and invest for free, automate, rebalance, and even borrow money when you need it.

If you’re ready to invest, learn how investing with M1 puts you in control of your financial future.

Disclosure

M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Past performance does not guarantee future performance. This is not an offer, solicitation of an offer, or advice to buy or sell any security and you are encouraged to consult your personal investment, legal, or tax advisors.

- Categories

- Investing

- Tags