Personal Loans with M1

Rates start at 7.99% APR1

Our multipurpose, fixed-rate loans help you borrow affordably. Every percentage counts when thinking long-term.

Absolutely no fees

You won’t have to pay origination fees, late fees, prepayment fees, or any other hidden fees that would get in the way of your goals.

Designed for you

Borrow $2,500–$50,000 over 2-7 years for almost anything. Funding is quick, so you can start using your money right away.

How our Personal Loans compare

Our flexible loans help you cover costs while spending less.

M1 rates are current as of March 2024. Information on competing lenders was accessed from each lender’s website in March 2024.

Make life’s big moments more affordable

Low rates and no fees make M1 Personal Loans the right choice for countless occasions.

Debt

consolidation

Pay off debts like credit card debt or high-interest loans.

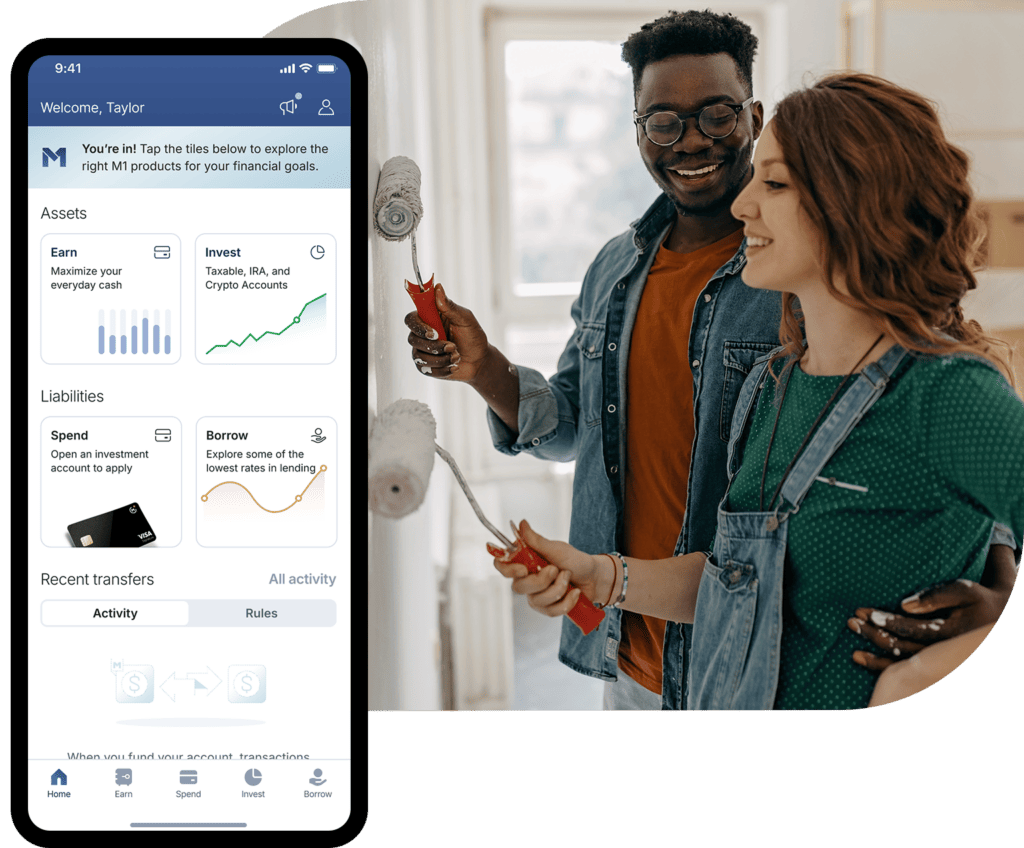

Home improvement

Fund major updates or repairs around the house.

Major purchases

Pay for things like a new RV, boat, or gym equipment.

Everything else

Cover moving costs, special occasions, and medical bills.

Check your loan options in minutes

without impacting your credit score.2

1 Rates are not guaranteed and are subject to change. Not all applicants qualify for the lowest available rate and rates are subject to credit history, income, term of loan, and other factors.

2 To see which personal loan rates and terms you qualify for, M1 conducts a soft credit check that will not affect your credit score. However, if you choose to proceed and continue your application, M1 will request a hard credit check from one or more consumer reporting agencies, which may affect your credit score.