M1 Plus

Get the best of M1 for just $3 a month

M1 Plus is a membership that gives you the best rates and tools that M1 has to offer. Your first 3 months† are free, then it’s just $3 a month.

Cancel anytime

Here’s how M1 Plus can pay you back

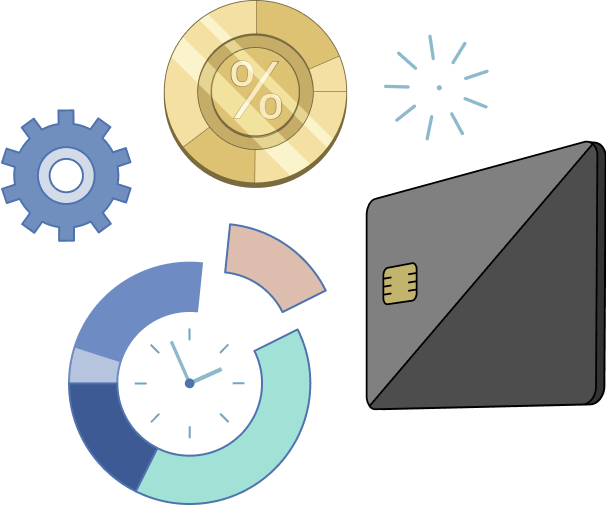

Spend on brands you already buy

The Owner’s Rewards Card by M1 gives you 10% cash back2 on major brands like Netflix and Spotify—with no annual card fee7.

See full reward tiers →

Borrow at a big discount

Avoid paying steep interest with competitors. For Margin Loans, borrow against 50% of your portfolio’s value on margin for 7.25%5.

Explore Margin Loans →

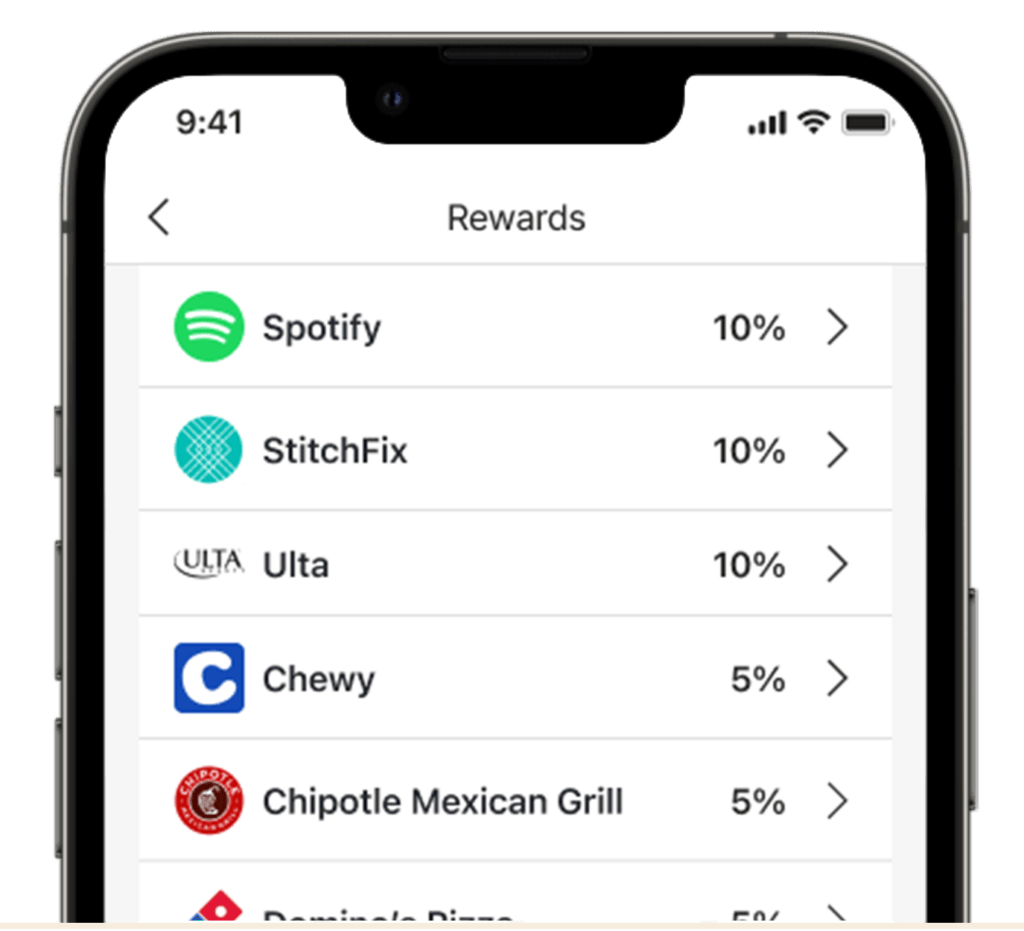

Take a closer look at the benefits of M1 Plus

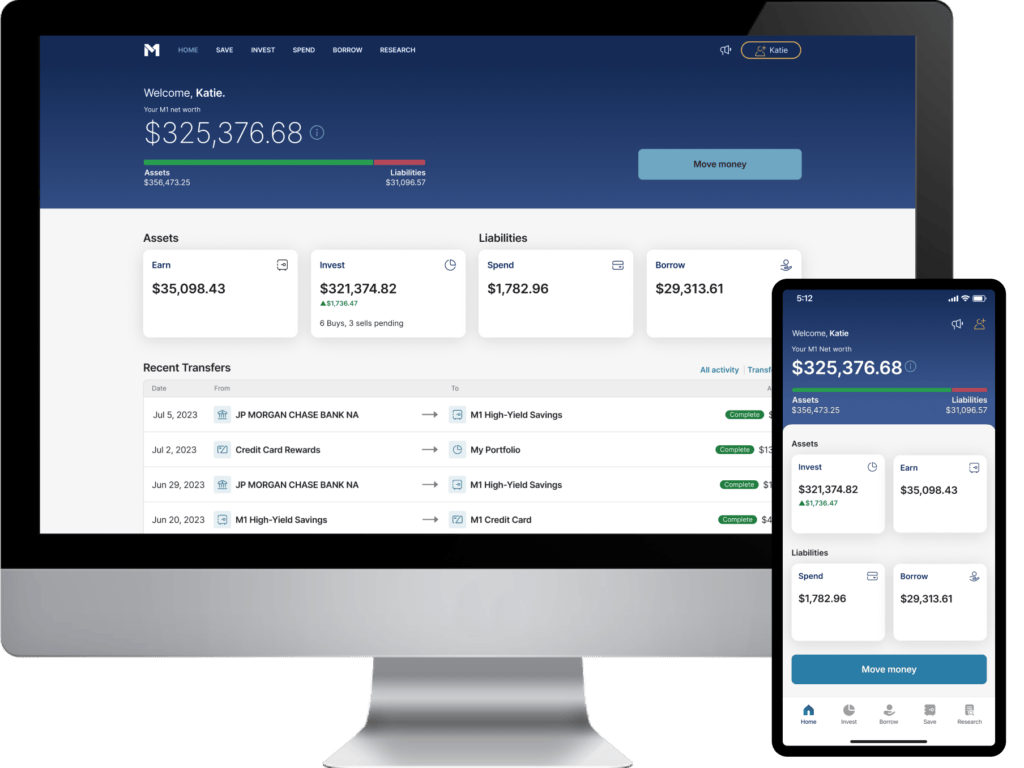

Look for the M1 Plus symbol while using the M1 app.

It means you’re enjoying a premium benefit!

Try M1 Plus for free

†Your free trial (a $9 value) begins the date you enroll in the M1 Plus subscription, and ends 3 month after (“Free Trial”). Upon expiry of the Free Trial, your account is automatically billed a monthly subscription fee of $3 unless you elect annual billing of $36 or cancel your subscription under your Membership details in the M1 Platform. We’ll remind you when your renewal date is approaching.

21.5% – 10% Owner’s Rewards cash back earned on eligible purchases subject to a maximum of $200 cash back per calendar month. Cash back rates of 2.5% – 10% require an active M1 Plus subscription (billed at $36 annually or at $3 monthly).

3Participate in both trade windows when you have $25,000 or more equity to comply with pattern-day trading regulations.

5Brokerage accounts on the M1 platform are either fully disclosed to APEX Clearing or cleared through M1 Finance LLC. Accounts numbers cleared by M1 begin with the letters GM. More information about finding your account number can be found in our Help Center.

All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future performance. Using margin can add to these risks. Users utilizing APEX cleared margin accounts should review the M1 APEX margin account risk disclosure before borrowing. Users utilizing cleared margin accounts should review the M1 margin account risk disclosure before borrowing. M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not available for Retirement or Custodial accounts. Margin rates may vary.

Brokerage products and services are offered by M1 Finance LLC, Member FINRA / SIPC, and a wholly owned subsidiary of M1 Holdings, Inc

6On-demand trading for M1 Plus members only, limited to 10 on-demand trades per calendar month. 24/7 availability is subject to scheduled maintenance.

7APR ranges from 19.99% – 29.99% based on creditworthiness of the applicant. APR will vary with the market based on the Prime Rate. There is no Annual Fee for the Owner’s Rewards Card. Rates as of June 2, 2023.

8B2 Bank is a member FDIC institution and does not itself provide more than $250,000 of FDIC insurance per legal category of account ownership as described in FDIC regulations. Additional FDIC insurance coverage is provided through B2’s Insured Deposit Network Program involving other FDIC insured depository institutions. Deposits may be insured up to $5,000,000 through B2’s Insured Deposit Network Program. Full terms of the Program can be found at m1.com/legal/agreements/HYSA_Agreement and a complete list of participating banks in the program can be found at m1.com/legal/agreements/depositnetwork.