M1 BUILT-IN MARGIN ACCESS

Borrow in seconds.

Pay back as you please.

with M1 Plus

Leverage up to 50% of your portfolio’s value while you stay invested. Get built-in access to margin lending when you have $2,000 or more invested in your taxable brokerage account. Rates start at just 7.25%1 for M1 Plus members.

Always consider the risks before using Margin. To learn more, see our margin account risk disclosure.

Borrow at low, fixed rates

With M1, you get the same low rate, no matter how much you borrow.

with M1 Plus

without M1 Plus

14.20%

13.575%

13.575%

13.75%

Competitor base rates shown. Loan balance determines competitors’ effective rate. Information on competing brokerages was accessed from each brokerage’s website in March 2024.

M1 rates are current as of March 2024. M1 Plus margin rate is subject to a paid annual subscription. Get M1 Plus for $3/month.

Tap into the power of your portfolio

Borrow against your portfolio

Use your securities as collateral to borrow.

Get liquidity without selling

Use up to 50% of your portfolio’s value without triggering taxable events.

No extra paperwork

Margin access is built-in—there’s no application required to get started.

Score a competitive fixed rate

Unlike other brokerages, our rates are the same no matter how much you borrow.

Repay at your own pace

Meet maintenance requirements and pay back your principal whenever you want; you’re only billed for interest monthly.

Flexible funds to

invest or spend

Stay invested while you spend. Margin can be used for just about anything—consolidating debt, making a big purchase or taking advantage of investment opportunities.

Strategic borrowing for savvy investors

Margin gives you a line of credit based on investments in your portfolio. Unlike a credit card or a personal loan,3 it’s secured by your investments, so there’s no minimum payment or late fees. You’re billed for interest monthly—you can pay back the principal when you please.

M1 Margin rate:

7.25% – 8.75%

Average credit card APR:

20.75%*

Average personal loan interest rate:

11.48%**

As of March 2024

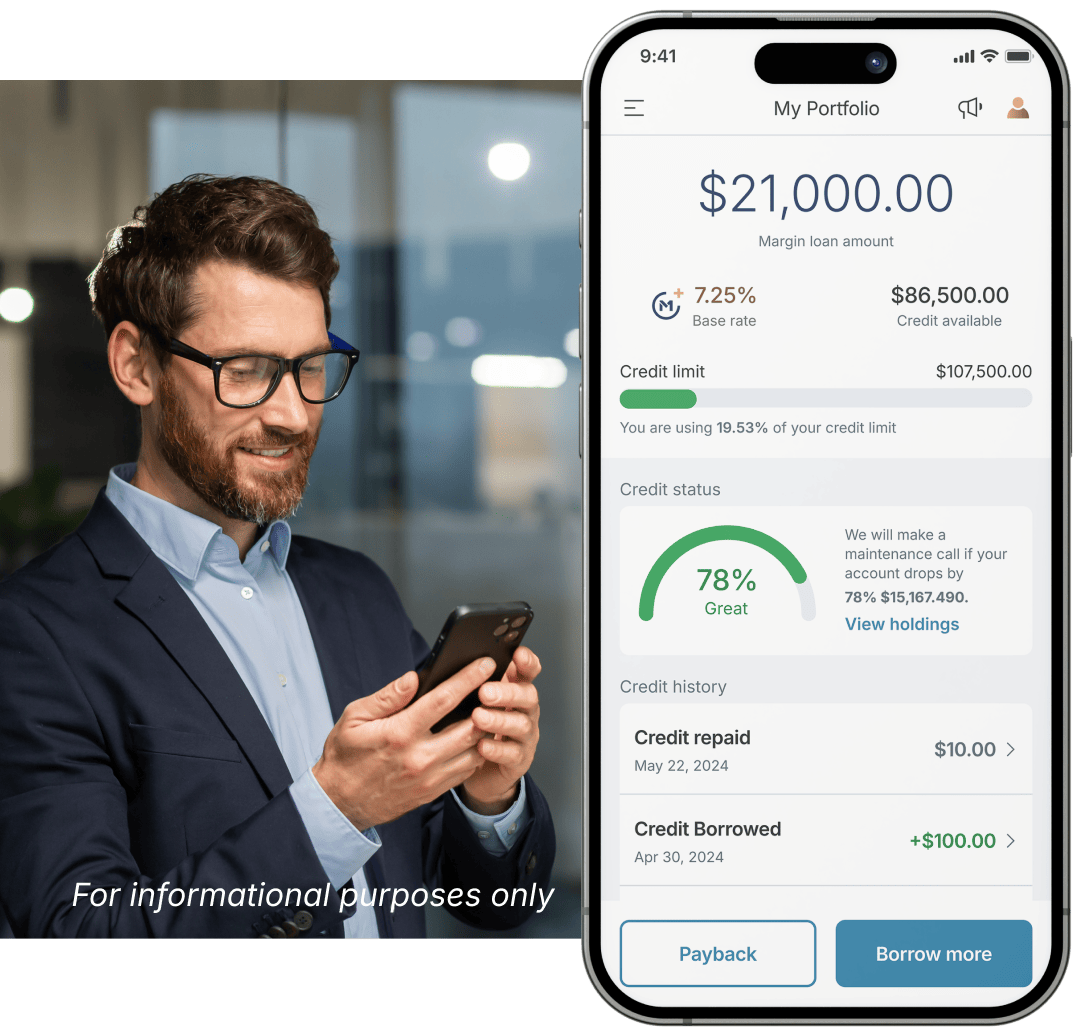

Your M1 margin HQ

Find built-in margin on the Borrow tab. From here, you can:

- Take out a margin loan in minutes2

- See how much credit you have available

- Pay off your bill in a few taps

- Watch your maintenance margin

- See your activity and billing history

Your margin questions,

answered

Looking for more detail? Visit the M1 Help Center.

1 M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not all securities are available for M1 Margin Loans and the amount that may be borrowed against a security is subject to change without notice. Available margin amount(s) of M1 Margin Loans may require greater than $2,000 per Brokerage Account. Not available for Retirement and Custodial accounts. Margin rates may vary.

2 Funds available in minutes in M1 Spend or M1 Invest accounts, may take up to 6 business days in external banks.

3 Learn the difference between a Margin Loan and a Personal Loan: https://m1.com/margin-loan-vs-personal-loans/.