The Financial Wellness Challenge by M1

It’s a new year, which means it’s the perfect time to take stock of your financial status! What’re your goals? Is your budget optimized? Does your portfolio look like it’s skipping leg day?

We surveyed over 2,000 investors to create a list of 7 habits you can practice to up your long-term investing game and reach financial freedom: Financial Wellness Challenge by M1! Keep an eye on your inbox for our weekly challenge emails.

New to M1? Sign up for M1 to join the challenge.

LET’S GET FISCAL!

Like a workout, there are no shortcuts—success in the Financial Wellness Challenge (and life) requires a long-term mindset and dedication to healthy habits. That’s our entire philosophy here at M1, and the Finance Super App is the all-in-one home gym your finances need to get in great shape!

THE ONLY WORKOUT WITH PIE

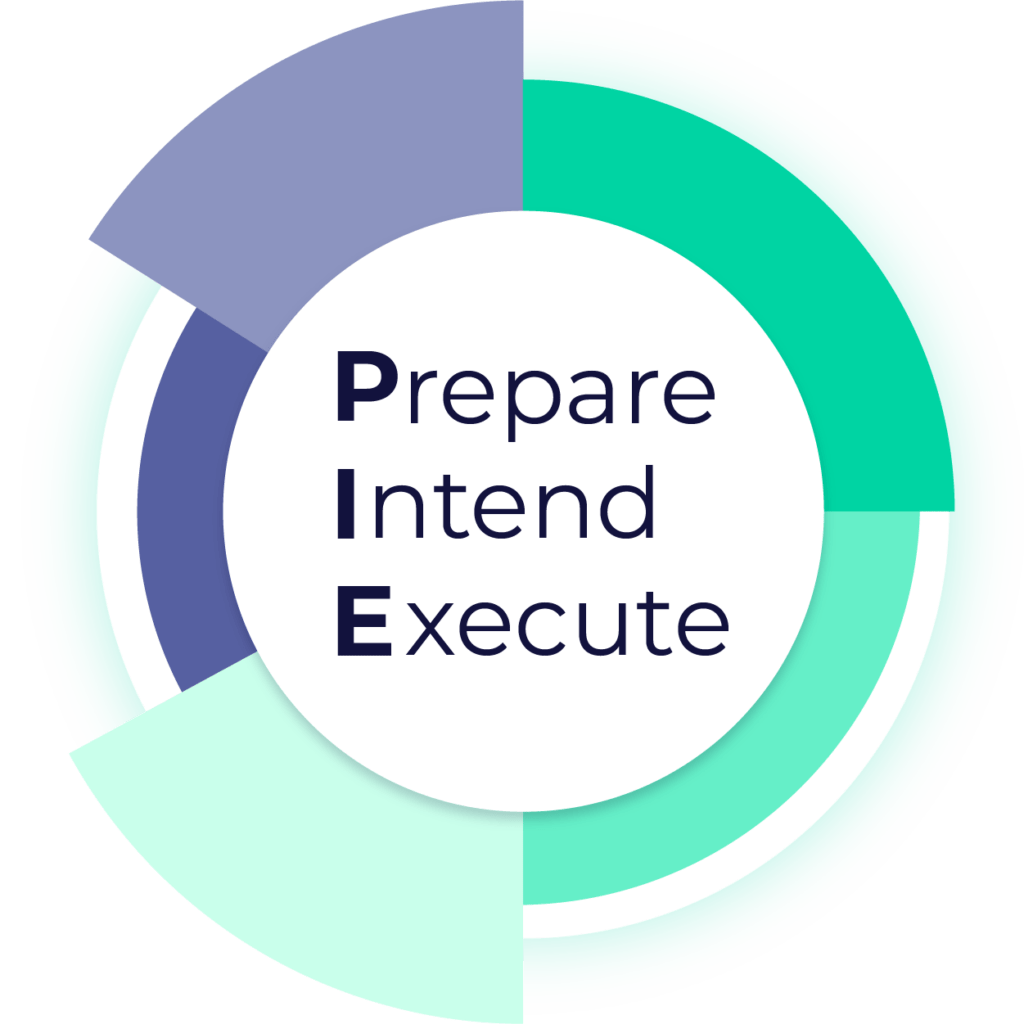

Our PIE (Prepare, Intend, Execute) framework is how we’ll tackle each area to improve your financial wellness.

PREPARE: Educate yourself, make sure you have everything ready, and think through your strategy.

INTEND: Get in the right mindset and plan your goals. Your attitude can be a game changer in helping you achieve your goals.

EXECUTE: Take action! We only get as far as our actions—and we don’t get cheat days.

YOUR FINANCIAL WORKOUT CIRCUIT

Just like a good gym routine hits your whole body, we want to help you finesse all the important parts of your finances. We have some of the best equipment to help you get in the best shape possible, and bonuses to give your money a boost.

Here are the areas we’ll focus on during the challenge:

SET YOUR GOALS

What do you want to achieve? We suggest “build wealth,” but the choice is yours. Write down your goals, then set up direct deposit into an M1 Spend checking account so your money starts working towards your goals sooner.

BUILD YOUR BUDGET

You’ll need to plan out how every dollar will work for you with maximum efficiency. Make sure every dollar spent, saved, and invested is getting you closer to your goals.

AUDIT YOUR FINANCIAL

WELL-BEING

Every dollar needs to pull its weight, and that’s easier when they’re working together on one platform. Transfer your money from another broker and you could earn up to $5,000 bonus to invest. Terms and conditions apply.

START INVESTING

Investing is kind of our thing, so trust us when we say it’s a great way to reach your goals. New to M1? Fund your new account with $1,000-$50,000 within your first two weeks and you could get up to $500 to invest, depending on how much you deposit. Terms and conditions apply. Then, set up recurring transfers so you can stick to your plan—even if you forget your plan.

PLAN FOR RETIREMENT

No one wants to work forever. Open an IRA with us, or rollover an old 401(k), then maximize your contributions and invest towards your dream of retirement. All that’s left is picking out your best Hawaiin shirt.

MANAGE YOUR SPENDING

It’s not all about saving, you need to spend too—and we’ll help you spend stronger with our unique credit card. With the Owner’s Rewards Card by M1, you could earn up to 10% cash back at select brands you own in eligible M1 Invest accounts. See Rewards Terms for more details.

STAY EDUCATED

We have plenty of automated tools, but that doesn’t mean you don’t need to check in and stay on top of things. After you graduate from the Financial Wellness Challenge, stay up to date on the world of finance—check out our blog and subscribe to our newsletters!

TAKE ON THE FINANCIAL WELLNESS

CHALLENGE WITH A GROUP!

Know someone who could benefit from a fast-paced finance refresher? Of course you do, everybody can! Refer your friends and family to M1, get them to join The Financial Wellness Challenge, and you could both get a bonus when they fund a new account.

It’s like a getting a workout in without breaking a sweat!