Choosing when to save and when to invest

Should you save or invest?

While the answer to this question will always depend on everything from your age, your income, your risk tolerance, and so on and so forth, it can almost always be broken down into three primary steps.

But before we begin, let’s define saving. Saving is simply the act of spending less than you make, which will be necessary to achieve your financial goals.

So when faced with the question “Should I save or invest?” the question really means something more along the lines of “When I have money left over, what should I do with it?” Here’s what to consider:

1. Aim to save 15% of what you earn.

This one is simple enough: in order to save money, you need to spend less than you make. You will have expenses in the future you will not be able to make with your then income, whether it’s a car, home, vacation, child’s education, or retirement. Saving now will provide the extra cash you need to work toward important financial goals.

A good rule of thumb is to aim to save 15% of your income. If you’re not there yet, set small goals to help you reach that benchmark. Analyze your budget for places you can cut back. When you get a raise or bonus, set it aside instead of immediately working it into your budget.

Once you’re spending less than you make, it’s time to decide what to do with the extra cash.

2. Start with your emergency fund.

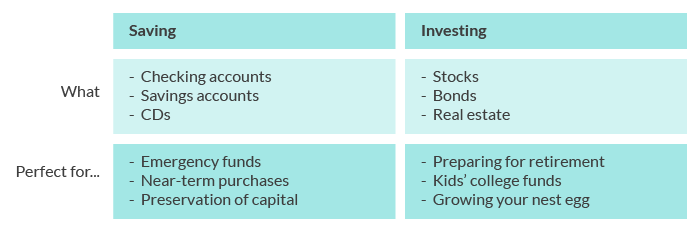

When people ask if they should save or invest their money, they’re often really asking if they should invest the money they aren’t spending or put it in a low risk account such as a checking account, savings account, or CD.

The two have very different goals. Investment accounts aim to help you make money on your money, while lower risk accounts serve the goal of capital preservation — you won’t earn much on the money, but it won’t lose value with market fluctuations, either.

The latter is the best place to start. At this point, your primary goal should be building up 3-6 months of living expenses. This way, if you lose your job or run into major unexpected expenses (think: medical emergency, major car repairs), you have enough money to cover you cost of living until you can get back on your feet.

This money will be stored in those low risk accounts, specifically checkings or savings. Because these accounts are essentially cash equivalents, you can withdraw the money whenever you need it and its value won’t be contingent on market conditions.

Once you’ve rounded out your emergency fund, it’s time to choose what to do with the rest of the money you’ve saved.

3. Invest everything else in a diversified portfolio that matches your goals and risk tolerance.

The downside to these low risk accounts is that your money sits idle, where it can’t accrue much (or any) value. So while they’re ideal for preservation of capital, they’re not a great place to keep your money for the long haul. You can think of savings accounts like investing in the dollar. Over time, inflation causes a dollar’s value to decrease, at which point the value of the money you’ve parked in a savings account decreases, too.

While this isn’t much of an issue for short-term goals, it’s the reason savings accounts don’t cut it for longer term goals such as saving for retirement or you child’s college education. By socking your money away where it only earns, say, 0.5% interest each year, you’re actually losing money when you factor in an annual inflation rate between 1 and 4%. Simply put: if your time horizon is long, you are almost guaranteed a worse outcome by putting it in a savings account.

While investments are a less certain place to park your money in the short-term, they do increase your chances at higher rate of return. While markets may dip over periods of days, months, or a few years, over longer spans of time, they move up and to the right — the precise reason the stock market is largely considered the best place to put your money for the long term.

You should invest anything over and above your emergency fund and tilt your portfolio towards higher-growth, but riskier investments the longer your time horizon. This gives you adequate time to ride out market fluctuations and, more important, allows you to benefit from compound interest.

You’ll likely want to start by socking away money for retirement. Individual retirement accounts (IRAs), 401(k)s, and the like on all allow you to reap the benefits of tax-free growth, so they’re often a good place to begin investing. Just remember: there are limitations around withdrawals from these accounts, so if you’ll need the money in more than 5 years but sooner than retirement (like for your child’s college education), you may want to opt for a taxable brokerage account instead.

To maximize your investment returns, consider investing for free with M1 Finance. With no commissions or management fees, you can be sure you’ll keep more of your hard-earned money and prevent extra costs from eating into your returns.

Once you’re investing enough to be on track to hit your long-term financial goals, you can always utilize checking accounts, saving accounts, and CDs to set money aside for shorter-term financial goals (less than 5 years), such vacations or weddings.

- Categories

- Investing

- Tags