Long-term investors focus on their current strategies as the 2020 presidential election approaches

The presidential election is weeks away. On a financial and psychological level, elections influence our thinking, mindset, habits, and strategy.

It’s not just the outcome of the election and resulting fiscal policies that have this effect.

Combined with an increase in retail investors (those who have entered the stock market), the pandemic, news cycles, and hype-fueled day trading, it feels like this election cycle would have a huge impact on investor sentiment.

Since day trading strategies fluctuate daily, the frequent election-based sentiment shift among day traders is inevitable. But what about long-term investors?

We asked 601 respondents to share how they’re thinking about their investments during this time.

Here’s what we learned about long-term investor sentiment around the election:

- When it comes to the big picture, investors aren’t sure which wins will benefit them the most

- Takeaways

Long-term investors are following more aggressive financial strategies

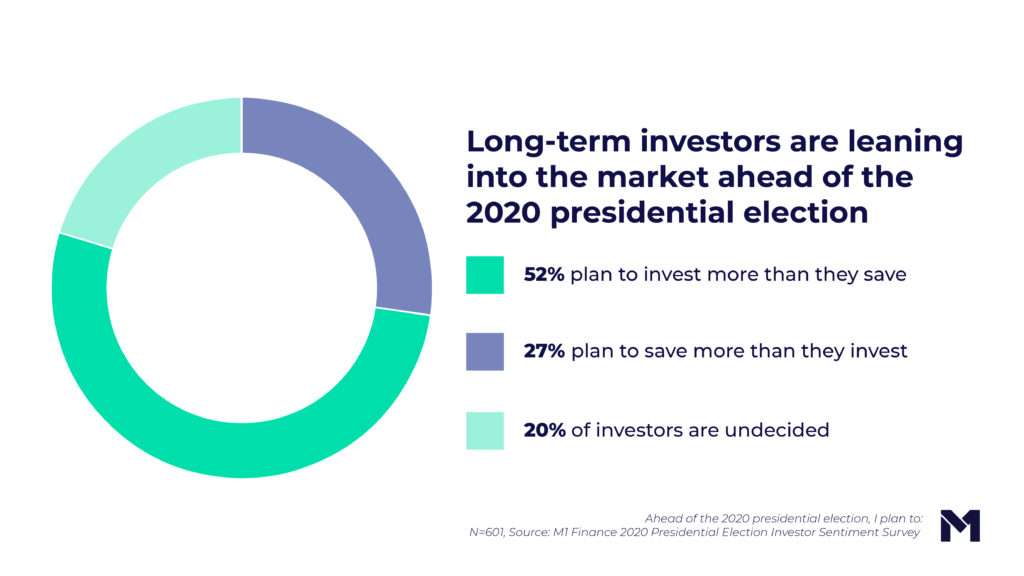

Even after experiencing strange markets and fluctuations, most investors aren’t trying to predict the market. According to our survey, 52% of long-term investors plan to invest more than they save ahead of the presidential election.

This compares to the 27% that plan to save more than they invest, and the 20% undecided.

What does this tell us?

It means long-term investors are heavily focusing on their time in the market, knowing that politics can elicit more emotions than data.

Younger investors (Millennials and Gen Z) are investing more aggressively than older investors (Gen X and Boomers)

It’s true that younger investors may be more comfortable with a riskier investing strategy than older investors, but less experience can also cause uneasiness during events like the election.

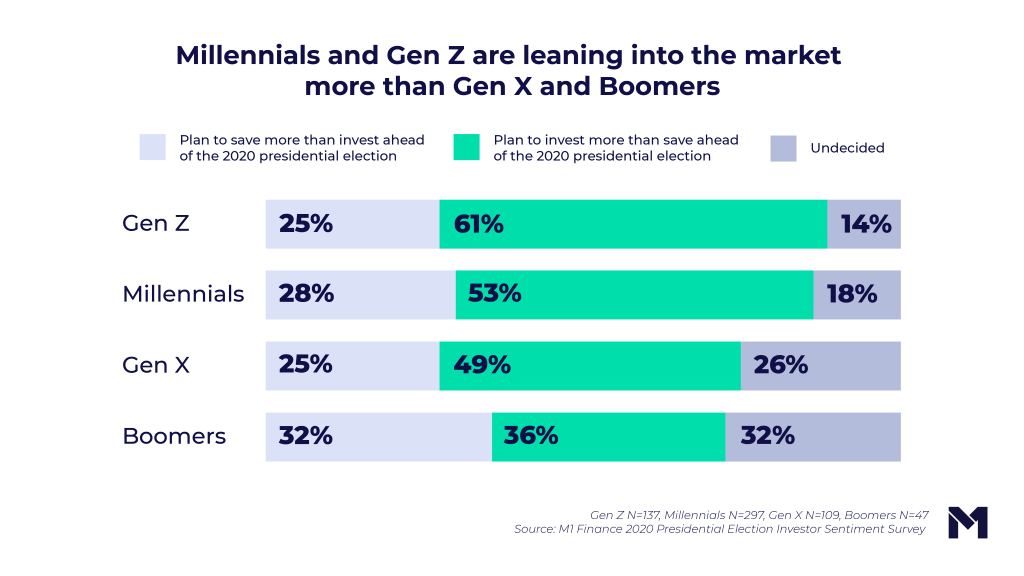

Our survey found 61% of Gen Z and 53% of Millennials plan to invest more than save ahead of the 2020 presidential election. This is in contrast with Gen X at 49%, and Boomers at 36%.

This means that despite the flashy headlines about younger traders on Reddit, younger long-term investors aren’t getting spooked by daily ups and downs.

On the other hand, Boomers plan to save more than they invest at the highest rate: 32%. This is followed by 28% of Millennials doing the same. Gen Z and Gen X followed the same pattern in the save over invest category, at 25%.

When it came to undecided investors, younger investors were more decisive than older investors. 14% of Gen Z and 18% of Millennials were undecided in their investment plans ahead of the election. This contrasts with 26% of Gen X and 32% of Boomers undecided on their investing plans.

Investors are confident in their current strategies

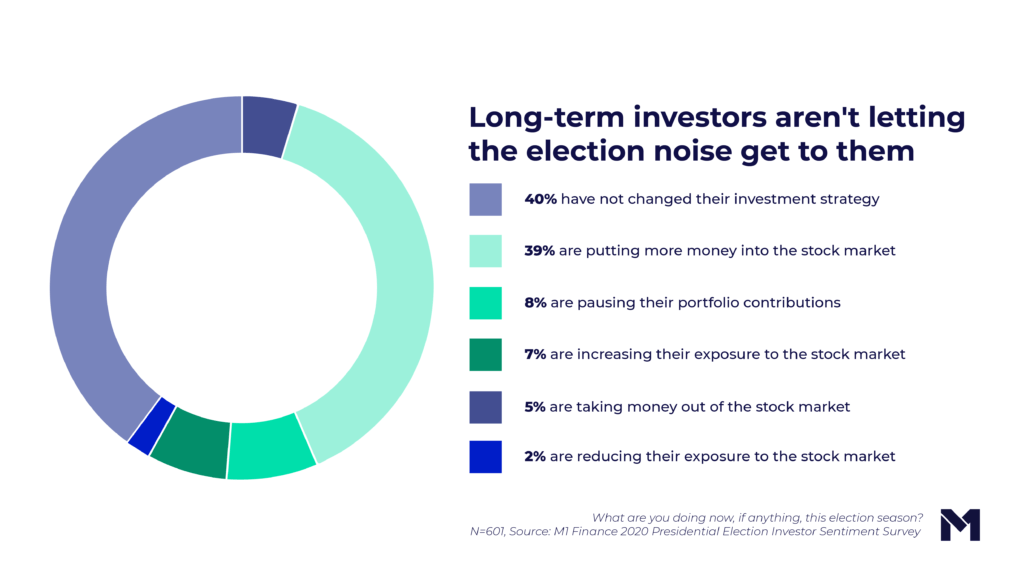

Not only do 52% of investors plan to invest more than save ahead of the election, but 40% have not changed their strategy. They’re staying the course and following financial habits they believe will drive them towards their goals.

39% are putting more money into the market specifically this election season. This may or may not have previously been a part of their strategy. After that, the numbers drop: only 8% of investors are pausing their portfolio contributions, and 5% are taking money out of the stock market.

Most investors plan to stick to their strategy after the election, no matter who wins

If every day feels like it brings a new rush of investors getting in on a trending stock, rest assured that these headlines aren’t affecting most long-term investors.

And before you ask – long-term investors can be just as tempted.

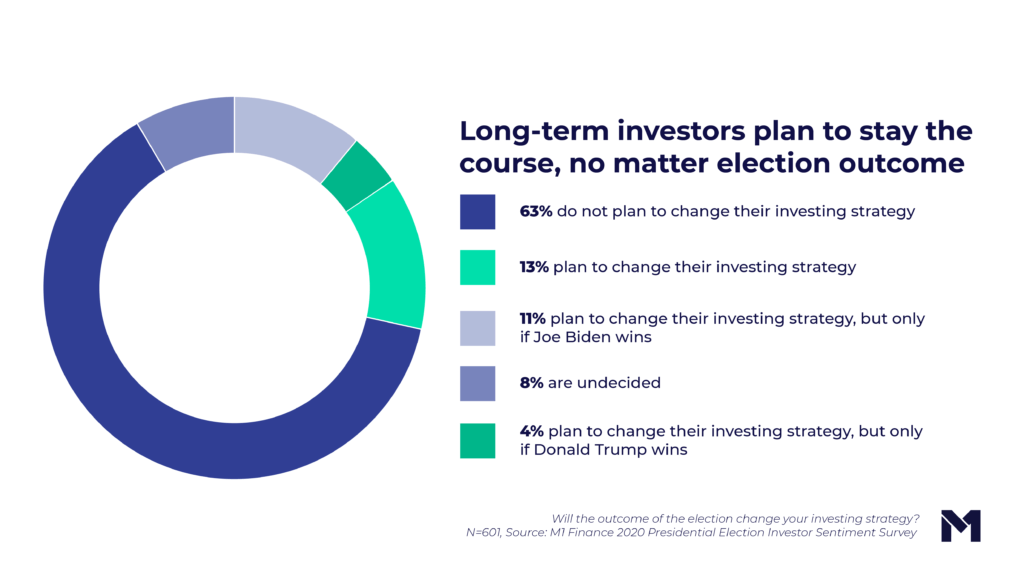

After the election, most long-term investors don’t intend to make drastic strategic changes when it comes to their finances. 63% do not plan to change their investing strategy, no matter the outcome of the 2020 presidential election.

In contrast, 28% do plan to make changes to their investing strategy.

13% plan to change their investing strategy in general, though not necessarily tied to either presidential candidate. 11% plan to change their investing strategy only if Joe Biden wins, and 4% plan to change their investing strategy only if Donald Trump wins.

8% of long-term investors are undecided.

Overall, the sentiment is clear: you can’t predict the market.

Investors are more decisive about their portfolio changes in the event of a Trump win than a Biden win

The numbers weren’t completely evenly split for this question, but they were close.

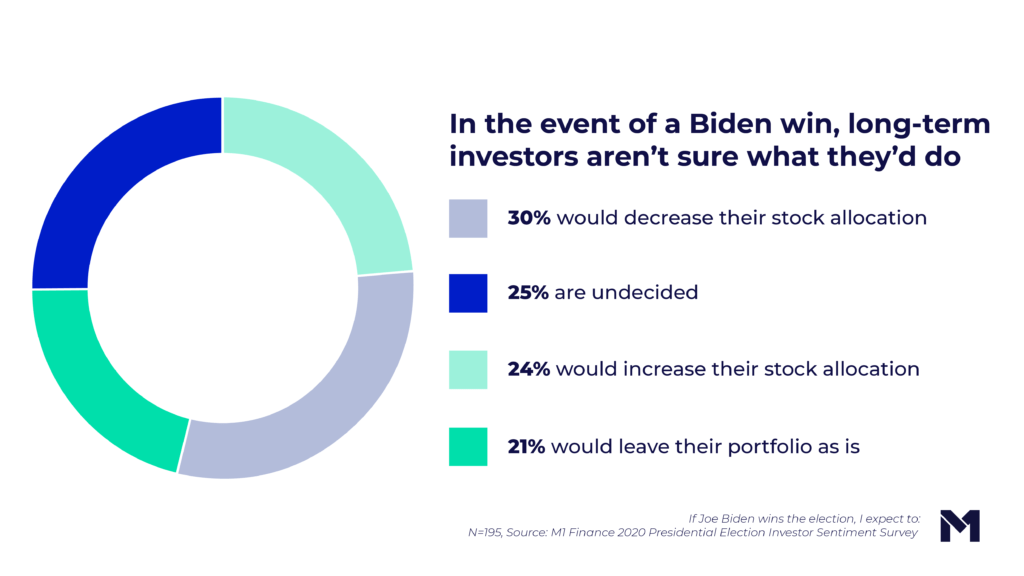

Of the long-term investors who planned to make changes to their investing strategy post-election, 30% said they would decrease their stock allocation if Joe Biden won. 24% would increase their stock allocation, and 21% would leave their portfolio as is. One-fourth (25%) are undecided.

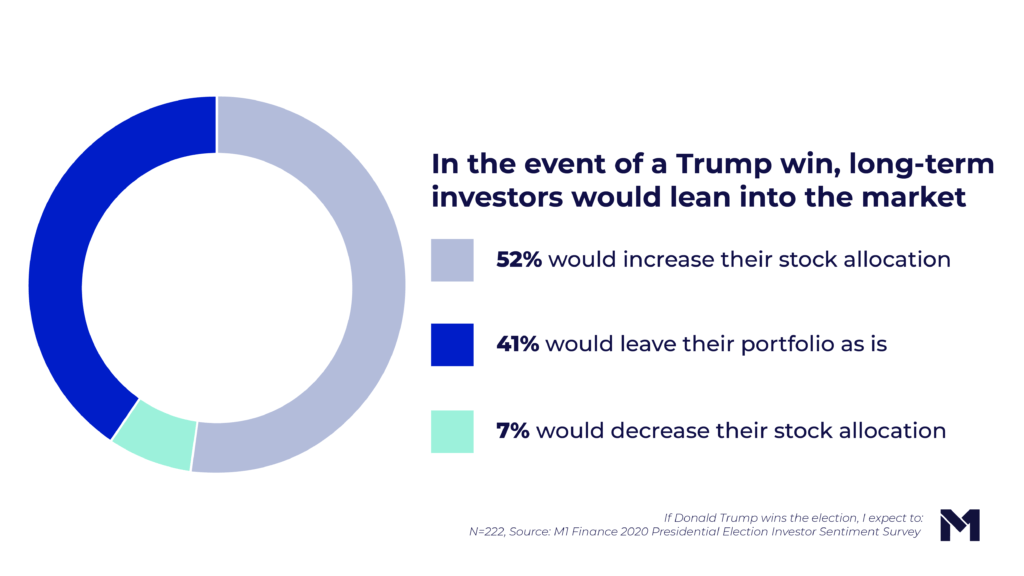

However, in the event of a Trump win, long-term investors who planned to make changes to their investing strategy post-election were more decisive:

In the event of a Trump win, 52% of investors making changes to their portfolios would increase their stock allocation. Only 7% would decrease their stock allocation, and 41% would leave their portfolio as is.

The biggest contrast: 0% of long-term investors planning to change their strategy post-election reported being undecided in the event of a Trump win.

As the election nears, it’s likely that investors continue to monitor the candidates’ economic policies alongside their holdings.

When it comes to the big picture, investors aren’t sure which wins will benefit them the most

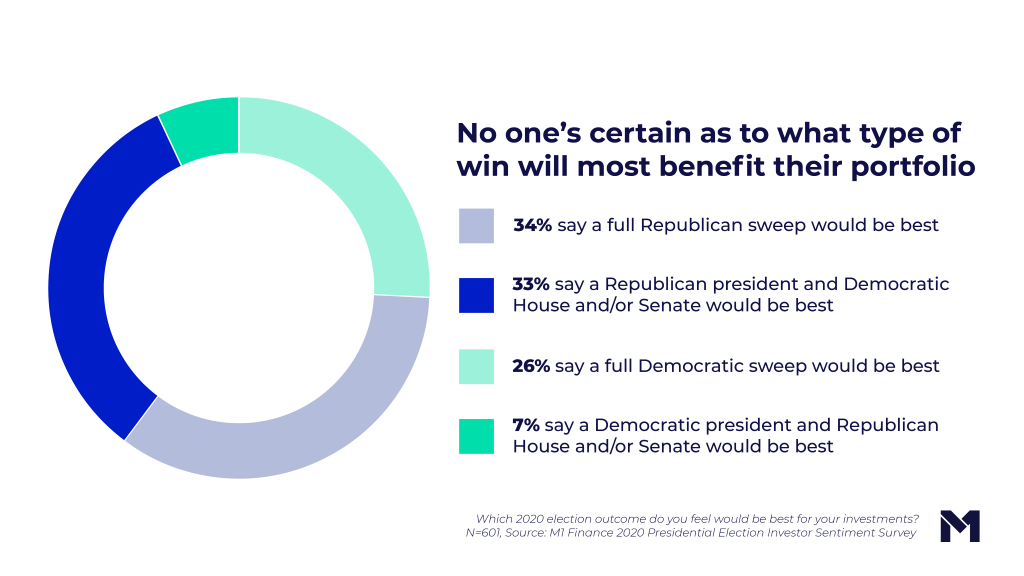

Our survey revealed that there was no one strong leaning towards a specific election outcome as it relates to investors’ portfolios.

While the presidential part of the 2020 election may take center stage in many conversations, long-term investors must also factor in the implications of officials lower on their ballots, like the House and Senate. The outcomes of these races also impact economic policy, and potentially the market.

However, long-term investors aren’t clear on what those impacts would be. 34% said that a full Republican sweep would be best for their portfolio, while 26% said that a Democratic sweep would be best.

33% said a Republican president and Democratic congress would be better for their portfolio, but just 7% said a Democratic president and Republican congress would be best.

This question was asked in the context of the 2020 election, though specific candidates were not named.

Takeaways

One thing was clear from our survey: long-term investors are focused on their strategies. While there is evidence of election-related impact in their thinking, most long-term investors aren’t running to jump ship on their current portfolios and strategies.

In fact, many knowledgeable long-term thinkers are emphasizing this sentiment loudly:

Investors should keep politics where it belongs: in the voting booth, and out of your portfolio.

Jason Zweig, The Wall Street Journal

We know most of these long-term investors are focused on their habits. But the question is, are you?

If you’re a long-term investor looking to zero in on your mindset (especially as the election nears), check out our free newsletter The Investor’s Mindset.

Sign up to receive it next week — and monthly after that.

- Categories

- Insights

- Tags