Transfer your account to M1

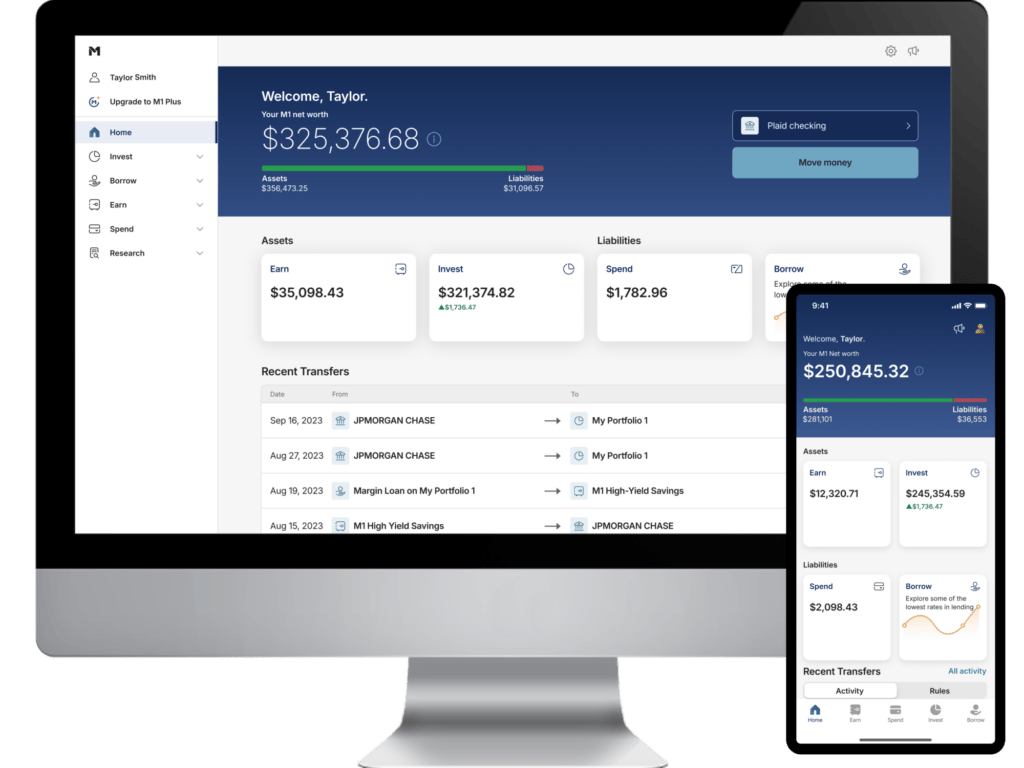

Why track accounts across multiple sites when you can build wealth on one powerful platform? It’s fast, easy, and secure.

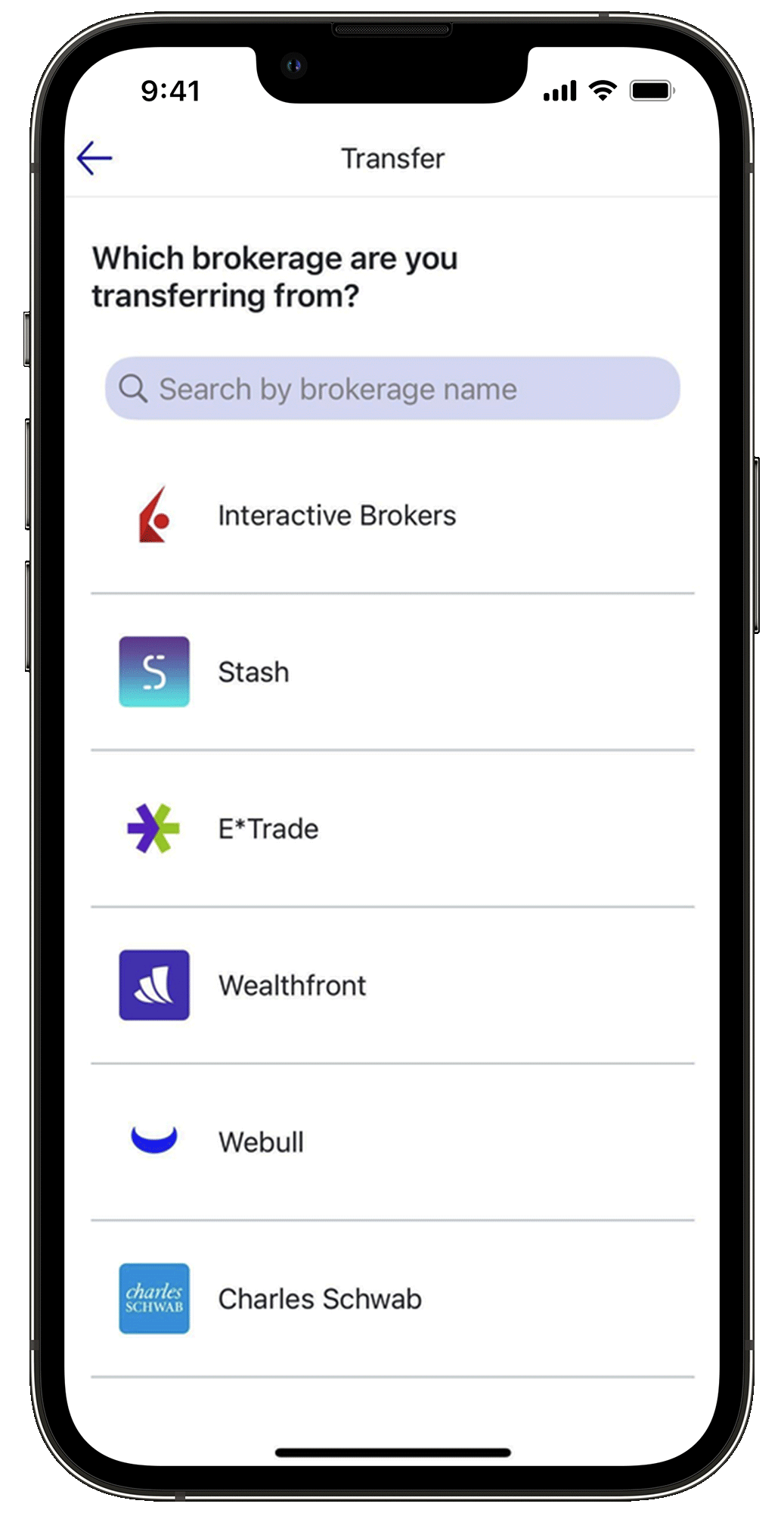

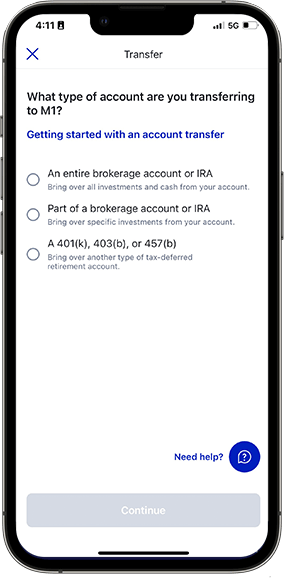

Move your investments in 3 steps

Thousands of clients have brought assets to M1 to the tune of $2.6 billion.

$380+ million

from Vanguard

$375+ million

from Fidelity

$292+ million

from TD Ameritrade

Account Transfer FAQs

Total control, total automation for your wealth today and tomorrow.

1If you choose to transfer your account to another broker-dealer, only the full shares are guaranteed to transfer. Fractional shares may need to be liquidated and transferred as cash.