M1’s Guide to Tax Season

Access your important documents, check key dates, and breeze through tax season stress-free.

Check important dates

Find your docs

Max out your IRA

Filing online

FAQs

You’re set up for success

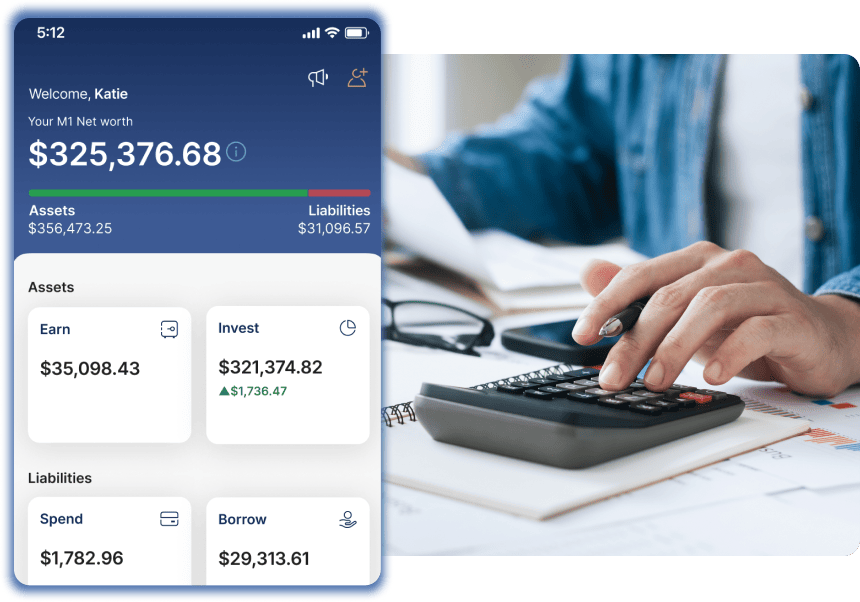

The federal government taxes investment income (such as interest and dividends) and realized capital gains. M1 uses built-in tax efficiency to help reduce the amount owed on taxes automatically, but you’ll still need to file a few forms with the rest of your taxes by April 15, 2024 in accordance with the IRS tax code.

Important dates

Here’s a look ahead at your tax season schedule. As an M1 client, you may receive multiple documents from this list or none at all—depending on the type(s) of account(s) you have.

Keep in mind, these dates are subject to change based on IRS guidance. We’ll continue to update this page with the most current information.

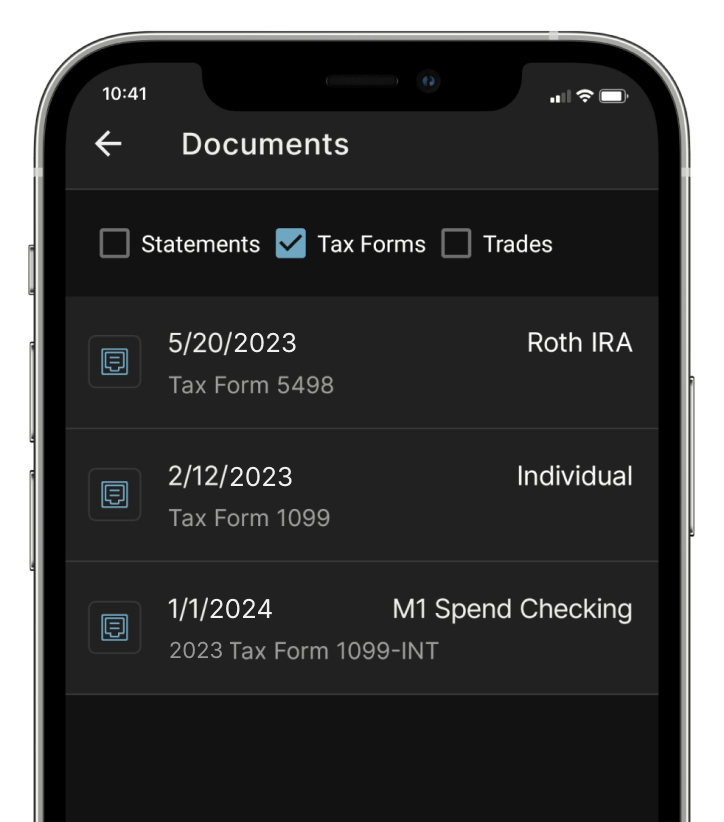

How to find your docs

Ready to get your important documents squared away? Here’s where to access them.Keep in mind: not every M1 client will receive tax documents. The documents you will receive depend on the type of M1 account(s) you have.

On web:

1. Log into your M1 account.

2. Click your name at the top left.

3. Click “View Account Settings.”

4. Click the ‘Documents’ tab and make sure only ‘Tax Forms’ is selected.

5. Once that is selected, you will see the tax form(s) if they were generated for your account(s).

On mobile? Get mobile-specific instructions here.

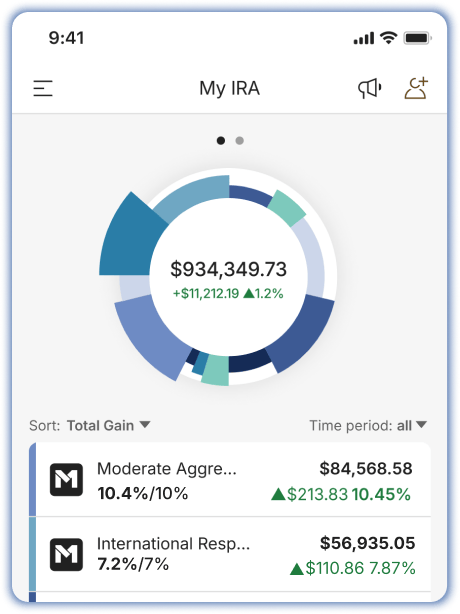

Maxing out your IRA

The deadline to max out your 2023 IRA is Monday, April 15, 2024 (Tax Day). For our most complete information about filing taxes for your IRA, check out our guide to tax season for your IRA.

If you would like to change the contribution year on an IRA deposit, please contact our Client Success team.

Filing your taxes online?

You’re in luck: M1 integrates directly with TurboTax to make filing your taxes easier than ever.

Keep in mind, if you benefited from an M1 Checking Account and/or a M1 High-Yield Savings Account this year, you will need to manually upload any 1099-INT or 1099-MISC documents that come your way.

Still have questions?

These articles by the M1 Team can help you navigate this tax season.

We’re here to help

M1 is not a tax advisor, but we can help you understand your options and take action.

Keep building your knowledge

When it comes to your personal finances, there’s always more to learn. Here are some of our most relevant blog posts to help you continue building your money smarts.

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.