How to think about this past week’s choppy market

The coronavirus has been headline news for a few weeks now. I was on the blue line train this morning headed to work in Chicago when I decided to check in on my M1 Finance account. I opened the app on my phone and saw my portfolio was down 10 percent for the week.

That’s not my preferred way to start my day, but OK, dips happen. It’s the stock market.

However, it’s what I decide to do at this point that will really make or break my investing strategy over the long term. And the way I see it, I have five choices in a market downturn:

- Adjust my portfolio targets: “This downturn made me realize that my portfolio choices were riskier than I have the appetite for. I am going to use some more conservative investment options.”

- Do nothing: “I know markets go up and down. I am confident this is temporary and my portfolio will stay the course.

- Invest even more and buy the dip: “Stock prices are down. It’s a great buying opportunity. I’m going to be more aggressive.”

- Take advantage of the dip: “I think the markets have another 10% to lose, I am going to move my positions to those that gain value when the market loses.”

- Sell my portfolio: “The big one is coming. I am going to hold everything as cash or cash alternatives until the danger subsides and re-enter when the markets have stabilized”

But which choice is the right one? This is the million-dollar question (figuratively and maybe even literally).

Of course, I’d love to give you a concrete answer on what to do when markets are volatile . But in reality, it depends on many personal factors, including age, risk tolerance, personality, portfolio construction, current investment, large planned purchases, family structure, health, and so on and so forth.

Depending on your unique financial situation, my answer could be one of them, some of them, all of them, or none of them. But it would be wildly irresponsible of me to blindly tell 200,000 people how to uniformly react to this market downturn. So I won’t.

Here’s what I will say: M1, in our tireless mission to develop the tools for the next generation of personal financial management, factored in choppy markets and down markets into our platform.

Markets can be volatile

Periods of choppy markets and downturns have happened before, they’re happening right now, and they will happen again.

As investors, and especially in times of calmer markets, we often look at historical market performance from a 10,000-foot view, hanging our hats on reassuring facts and statistics like this one:

“The average annual return for the S&P 500 since its inception in 1928 through 2017 is approximately 10%.”

See? History is on our side. The facts are on our side. We invest our money today, and in 10 years we can reasonably expect – though history is no predictor of the future – to earn somewhere around 159.4% in returns (with compounding).

Simple, right?

If that’s the case, though, why don’t we all just do that?

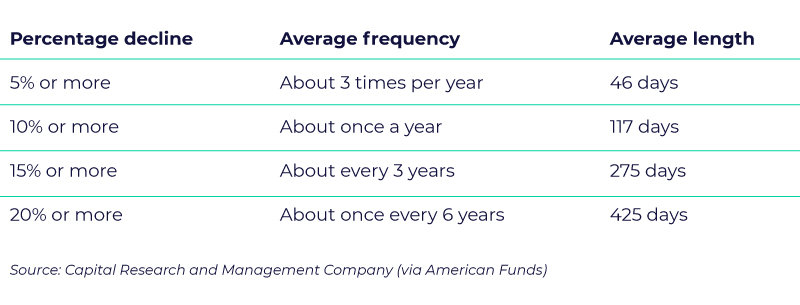

Because reality sets in. It’s difficult to check emotions at the door. The markets aren’t on a direct path: they go up, and they go down, and downturns occurs more wildly and more often than we tend to see from that 10,000-foot view. Just take a look at the magnitude and frequency of downturns in the table below:

And last week’s downdraft is the fifth worst in stock market history, so it feels particularly acute.

The point is, market downturns happen to all of us — often more than once in our lifetimes — and it’s important to be prepared, knowing markets don’t just move upward in a linear fashion.

As a wise man once said:

“Everyone has a plan until they get punched in the mouth.”

Mike Tyson

We all have a grand plan of how we want to save and invest. We should also have a plan for how to react in choppy markets.

At M1, we want to provide the tools you need, so when you do get “punched in the mouth,” you can assess your situation and implement the smartest decisions to move forward.

So when you look at your portfolio returns and see a negative number, don’t immediately rush to panic. As the New York Times noted*:

“Humility and patience are more helpful than panicky moves to time the market.”

We don’t know the economic effects of the coronavirus yet. Is it a short-term blip or a worldwide drag on the economy for the next year? Let’s use this as a time to assess our goals, assess our financial situation, and assess our investments to make informed, level-headed decisions. And, most importantly, know how to use the tools available to you in a market downturn to best continue marching toward your financial goals.

For M1 users, these features can help you react to any downturns that come your way, no matter what your unique financial situation:

Portfolio-based investing

For evaluating performance and adjusting your targets

M1’s intuitive Pie design allows you to easily digest how choppy markets have affected you and react accordingly. Here, performance attribution is key: when markets are choppy, you need to be able to quickly diagnose how and where these changes are affecting your portfolio. We designed the M1 portfolio specifically with this in mind, allowing you to view performance of your portfolio as a whole or drill down into specific slices, then efficiently adjust your targets if necessary.

Dynamic Rebalancing

For taking advantage of falling prices and buying the dip

M1’s Dynamic Rebalancing is built to take advantage of opportunities to buy low. When individual stocks or funds in your portfolio dip in value, these slices become more underweight in relation to their targets. As you invest more money in your portfolio, the M1 platform intelligently deploys more of that money to underweight slices, automatically taking advantage of buying opportunities and bringing these slices back up to their target weights.

M1 Borrow

For leveraging your portfolio to buy the dip

If you aren’t already familiar, M1 Borrow is a flexible, low cost line of credit. If you check your portfolio and see the choppy markets as a buying opportunity, you always have access to more capital at a click of a button.

So, I’ll spend a few minutes of my train ride checking which slices of my Pie are down for the week, evaluating if I need to shift my targets a bit here and there or continue investing as usual. Either way, I know I have the tools I need to make the right decision for me, no matter what happens next week, next month, next year, and beyond.

Recurring deposits

For making it easy to stick to your plan

During market downturns, our worst enemy is often ourselves. These are the times during which staying the course and sticking to our plan is often the most difficult. It’s all too easy for our emotions to take over: we panic, we sell, and we forget all about our long-term goals. This is when automating our investing is the most crucial. Setting up recurring deposits in the M1 platform allow you to stick to the plan with zero effort and helps us get out of our own way. Setting an investing schedule forces you to opt out of making smart financial decisions rather than opt in, so you’re not tempted to skimp on contributions.

M1 Spend and cash balances

For putting money into a cash position to wait out the storm

Cash is sometimes an underutilized or forgotten asset class when creating our investment plan. At M1, we have a couple of cash options. M1’s Spend checking account is a place to park cash while waiting for another opportunity, and people who subscribe to Plus earn 0.00% APY on all cash. The other cash option with M1 is setting your cash balance thresholds in M1 Invest higher and keeping cash in your brokerage account while waiting for your next buying opportunity.

*This quote is taken from the print version of this article, found in the Sunday, October 14th edition.

- Categories

- Insights

- Tags