Trade wars and your portfolio

Summary:

- Rumblings of a tariffs began during Trump’s presidential campaign and have turned into a full-blown trade war.

- Tariffs affect the stock market indirectly and unevenly – while some investment types will suffer, others can thrive.

- Balancing the types of investments in your portfolio can help minimize any negative impact a trade war has on your returns.

The US-China trade war is creating uncertainty for financial markets by clouding the global economic outlook. Stocks rise and fall as the latest headlines unfold and, while investors look for signs of an eventual ceasefire, a lasting truce has remained elusive.

While the day-to-day gyrations of the stock market can be unnerving, short-term volatility can also create longer-term investment opportunities for savvy investors.

Here’s a look at what’s happened in the US-China trade war so far, how it has impacted the US economy and stock market, and how it might affect investors’ portfolios in the future.

Shots fired: A brief history of the current trade war

Trump laid the foundation for a spat with China during his presidential campaign. As early as March 2016, at a rally in Pennsylvania, he threatened to impose tariffs to counter China’s trade practices. Trump also complained that China’s entry into the World Trade Organization allowed for the “greatest jobs theft in history.”

While the Trump Administration has produced no official list of grievances against China, the tensions are generally related to a handful of issues:

- The United States argues that China steals intellectual property and technology through espionage and other tactics.

- Huge trade deficits let China sell massive amounts of products to the US; with the US dollars they receive, they buy American assets.

- China is manipulating its currency, the yuan, to unfairly benefit on trade.

Trump fired the first shots in the trade war shortly after taking office. He ordered a probe of Chinese intellectual property in January 2018; the first round of tariffs was unveiled in March. (Initial tariffs targeted washing machines, solar panels, steel, and aluminum from a variety of countries, not just China.) From there, things took off:

In April, China retaliated with 25 percent tariffs on 128 US products.

Trump fired back and announced tariffs on $50 billion in goods from China.

By June, China had responded again with fresh tariffs on another $50 billion of US products. However, after months of negotiations, the US and China had agreed to a partial (Phase One) trade deal that included an agreement not to escalate the tariff war. The deal was signed just before a December 15th deadline for increased tariffs on Chinese imports.

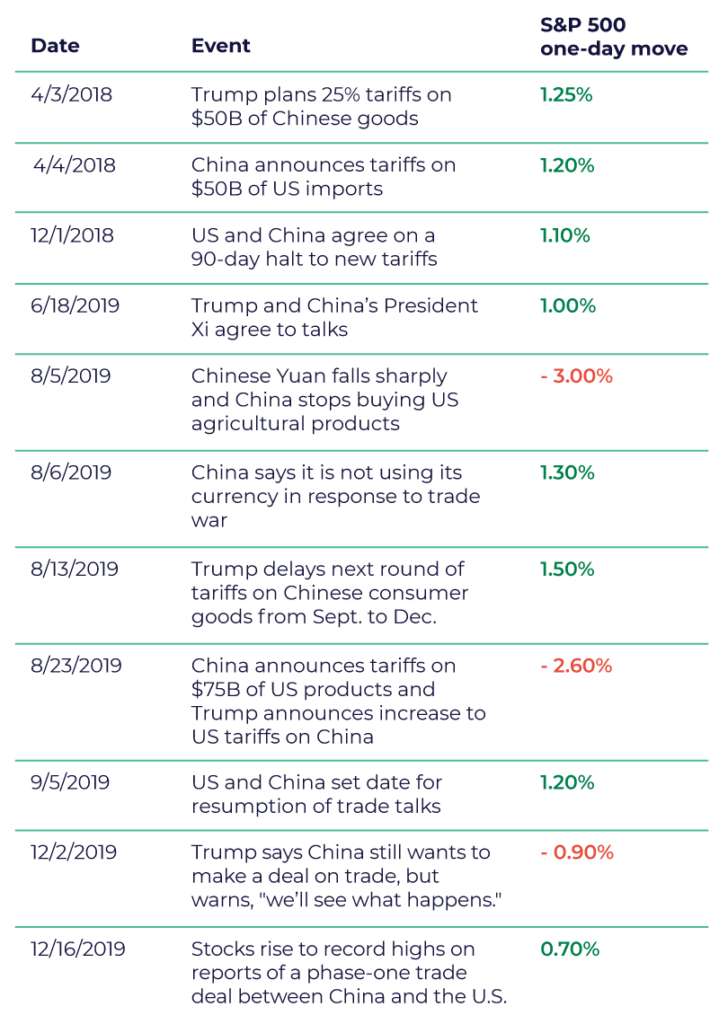

Here’s a breakdown of some major trade war moments and their effect on the S&P 500.

The back and forth continued through the rest of 2018, until late in the year, when the United States and China agreed to a 90-day halt on new tariffs. Markets breathed a sigh of relief (as evidenced in the 1.1 percent climb).

After a series of failed trade talks, the multi-month truce was followed by a new round of tariffs. By August, Trump had announced that, in addition to $250 billion worth of existing goods with 25 percent tariffs, the US would levy an additional 10 percent tariff on $300 billion worth of Chinese goods in September 2019.

(Some of those tariffs – on key consumer items like computers and cell phones – were later pushed back until December 15 so as not to negatively impact the important holiday shopping period.)

China promptly responded by saying it would stop buying US agricultural products and announced in late August that it would add retaliatory tariffs on $75 billion of US imports, adding another 10 percent to existing levels.

The United States then said it will raise all current tariffs to 30 percent from 25 percent. It will increase tariffs announced for September and December from 10 percent to 15 percent.

Following these escalations, a bit of positive news surfaced in early September: the two countries agreed to hold trade talks in October. The S&P 500 rebounded nearly five percent from its August 23 lows through mid-September.

How Tariffs Work

As you can see, tariffs have the power to affect the stock market. But their impact isn’t direct. Instead, market movement happens when investors shift their funds based on what they think will happen in the larger economy, given the reality of tariffs.

While nobody can predict the movement of the markets, it’s also true that understanding how tariffs work can help investors understand how they’re likely to affect various parts of the economy, including the stock market.

Here’s a primer.

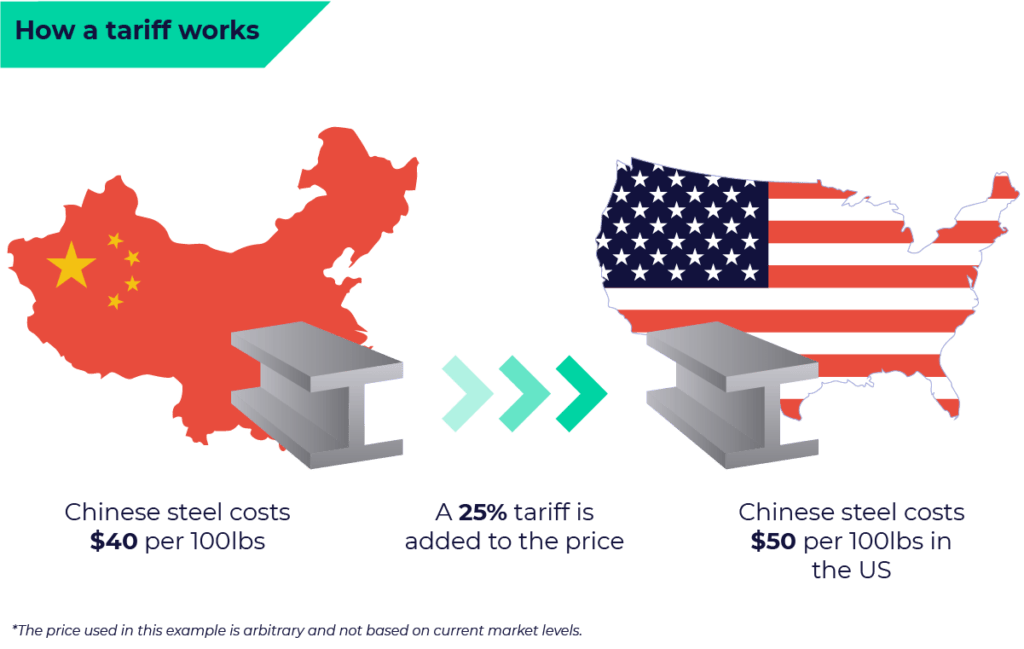

A country can impose tariffs on any import (i.e., any product coming in from overseas). Tariffs are often used to protect important domestic industries from foreign competition. In this case, the Trump administration is attempting to change China’s behavior by punishing them with tariffs.

Trump’s tariffs work like this: A cargo of products – let’s say steel – comes into the United States from China. Most US companies that buy steel have contracts with an importer of record (a middleman) who understands the rules and regulations of the US Customs and Border Protection system. Because of the tariffs, the importer now pays a higher price for the steel.

The steel importer must then choose whether to pass on the costs of the tariffs to its customers in the form of higher prices.

Let’s get more specific: let’s say the US company buying the steel is an automaker. Because of the tariffs, it now costs them more to produce cars. They can choose to pass their higher costs on to customers or absorb the cost and see a decline in their profit margins.

Neither option is good for a publicly traded company: if the company raises prices, sales will likely fall; if it absorbs the tariffs, profits fall.

Investors know this, which is why stock prices tend to fall on news that tariffs are increasing and rebound when there are indications that we’ll find a non-tariff resolution to our trade differences.

More broadly, experts agree that tariffs are generally not a good thing for economic growth. This is how the Tax Foundation puts it: “Economists generally agree that free trade increases the level of economic output and income, and conversely, that trade barriers reduce economic output and income.”

That’s because tariffs not only raise prices for businesses and consumers alike, they also reduce the amount of the goods and services available. Economic growth, employment, and individual incomes are negatively impacted.

Think Positive: The Economy’s Still Strong

The good news for investors is that, despite market fluctuations around tariff news, economic data so far does not suggest the US economy is falling into a slump because of the trade war.

Unemployment is at 50-year lows. Swings aside, the US stock market is setting record highs in late 2019. Rising incomes are helping maintain robust levels of consumer spending. The US economy is like a super tanker – it moves forward in a slow, steady fashion and does not turn on a dime.

Other evidence for overall economic strength shows up at the gas pump, where prices are falling. The prospect of protracted weakness across the global economy has raised concerns that demand for energy will not keep up with readily flowing supplies.

As a result, the average price of gasoline in the summer of 2019 in the United States is just north of $2.50 per gallon – well below last year’s levels of almost $3 a gallon. Falling gas prices can have a positive economic impact because the less money people spend on gas, the more they have for other spending.

This translates to positive performance across various industries, which typically translates to gains in the stock market.What’s more, not all investments have fared poorly during the US-China trade war. Gold prices have been setting six-year highs.

The same is true of bonds, which are moving higher in price, and sending yields lower. As a result, mortgage interest rates are falling, and a longer-term 30-year loan, at 3.55 percent, was near record lows over the summer. Low mortgage rates often mean better performance for real estate-based investments, including REITs.

Understanding these nuances is an important part of hedging risk as an investor: it’s not possible for all of your investments to perform well at all times. But if you balance your portfolio such that some of your investments are likely to perform well when others perform poorly, you can minimize your overall risk exposure and enjoy steadier returns.

The Tangled Web We’ve Woven

The US-China trade war started with modest tariffs on a handful of imports and has escalated into a complicated web that seems difficult to untangle. In addition, the trend has been for escalation rather than de-escalation. Hopes for a speedy resolution seem to have faded.

As a result, financial markets might remain fixated on trade war headlines and see knee-jerk reactions to each new development in the short run. Recession fears might weigh on stocks on days when the economic statistics are not too rosy.

Longer term, if the US achieves its goal of leveling the playing field with China, the benefits from the trade war are hard to calculate and could be substantial. After all, if American companies maintain greater control of intellectual property rights and can better compete on the global trade front, earnings will likely improve, resulting in more growth, more jobs, and higher incomes.

But like any war, once a trade dispute begins, it is difficult to predict how it will end. There is a world (literally) of uncertainty going forward.

The key takeaway is to focus on the big picture and understand that, while the economic outlook is perhaps cloudy due to trade conflicts, it is too early to determine if the longer-term impact will be positive or negative. In addition, balancing investment portfolios with assets like gold, real estate, and bonds can help smooth out major fluctuations in value.

Keep in mind

M1 relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. All investing involves risk, including the risk of losing the money you invest, and past performance does not guarantee future performance. Nothing in this communication is an offer, solicitation of an offer, or advice to buy or sell any security and you are encouraged to consult your personal investment, legal, and tax advisors.

- Categories

- Insights

- Tags