Using tax-loss harvesting to turn capital losses into tax breaks

Sometimes, the market declines and leaves you wondering what you should do. Buy? Sell? Both? For some, the answer may be “both”— this is called tax-loss harvesting.

Tax-loss harvesting is a strategy that turns investment losses into tax breaks. If you’ve had a few investments perform poorly this year, counting your losses could be a way to lower your tax bill without negatively impacting your overall long-term investing strategy.

We’re not here to tell you what to do or what not to do with your investments, because everyone’s situation is unique. However, when the market is serving lemons…well, you know the rest. Before making any moves, it’s best to understand this strategy and the impact it can have on your portfolio.

What is tax-loss harvesting?

Tax-loss harvesting is selling security positions that have fallen in value to realize losses. This can help offset taxable gains from other security sales and/or the taxes owed on a limited amount of ordinary income.

The Internal Revenue Service (IRS) limits the maximum amount of capital losses that can be used for tax-loss harvesting. A federal taxpayer can write off up to $3,000 of short-term losses against short-term gains in a single tax year. For married couples, the limit is $1,500.

Tax-loss harvesting can be done at any time during the year, but most investors wait until the end of the tax year to assess their portfolio’s performance and its impact on their taxes.

While tax-loss harvesting is often used for short-term losses, it can also be used for long-term losses. The same $3,000 cap applies to long-term capital losses, and the IRS has rules that allow additional losses to be carried forward into the following tax years. For example, a $15,000 loss can be spread over five tax years.

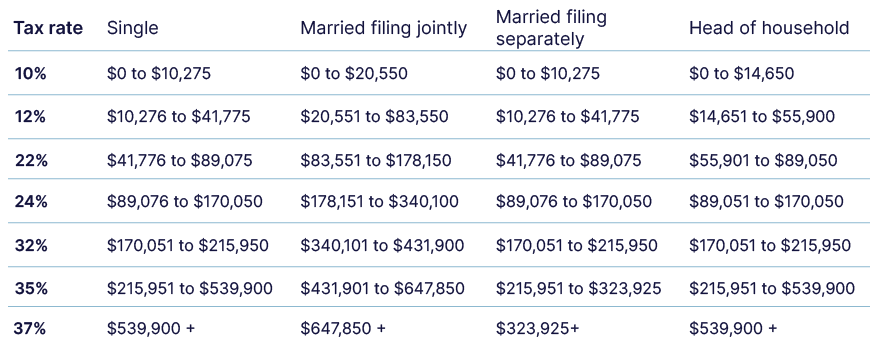

2022 short-term capital gains tax rates

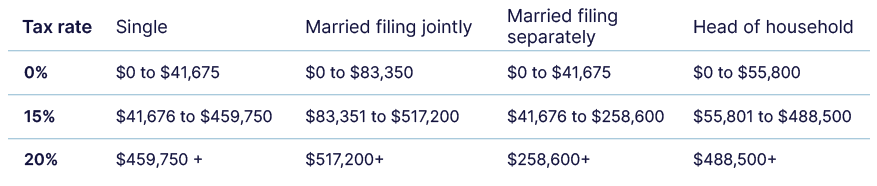

2022 long-term capital gains tax rates

Your specific tax savings depend on your tax bracket, so let’s jump into the process.

How tax-loss harvesting works

To understand how tax-loss harvesting works, let’s say you own a position in Company A whose value has tanked over the last three weeks. You don’t think it’s going to recover in the next 30 days, or you have other realized gains you’d rather not pay taxes on.

So, you’re considering selling Company A.

But you’re also a buy-and-hold investor. You want to stay in the market, and you still like Company A’s long-term prospects. In fact, you’d buy back the company’s shares immediately if you didn’t have to worry about the “wash sale” rule (see below). Here are a couple of options to consider if you decide to sell:

- Immediately put your proceeds into Company A’s top competitor (or a Pie of multiple competitors).

- Buy an ETF that’s focused on Company A’s industry.

Once you ride out your 30 days with your new position(s), your tax-loss would be properly harvested. You could reverse your positions and buy into Company A, if you still wanted to do so.

Let’s look at another example that involves multiple holdings.

Say an investor earns income that places them into the highest capital gains tax category. They decide to use tax-loss harvesting to offset their taxable gains. For the 2021 and 2022 tax years, that means the investor earned $445,851 if single and $501,851 if married filing jointly. The long-term capital gains tax rate for this investor is 20%, and the short-term capital gains tax rate is 37%.

Here’s how the investor’s portfolio performed over the year:

Portfolio:

- ETF A: $125,000 unrealized gain, held for 501 days

- ETF B: $65,000 unrealized loss, held for 671 days

- ETF C: $50,000 unrealized loss, held for 98 days

Trading activity:

- ETF E: Sold, realized a gain of $100,000. ETF was held for 426 days.

- ETF F: Sold, realized a gain of $75,000. Fund was held for 143.

From the portfolio, the investor can ignore ETF A because it was an unrealized gain.

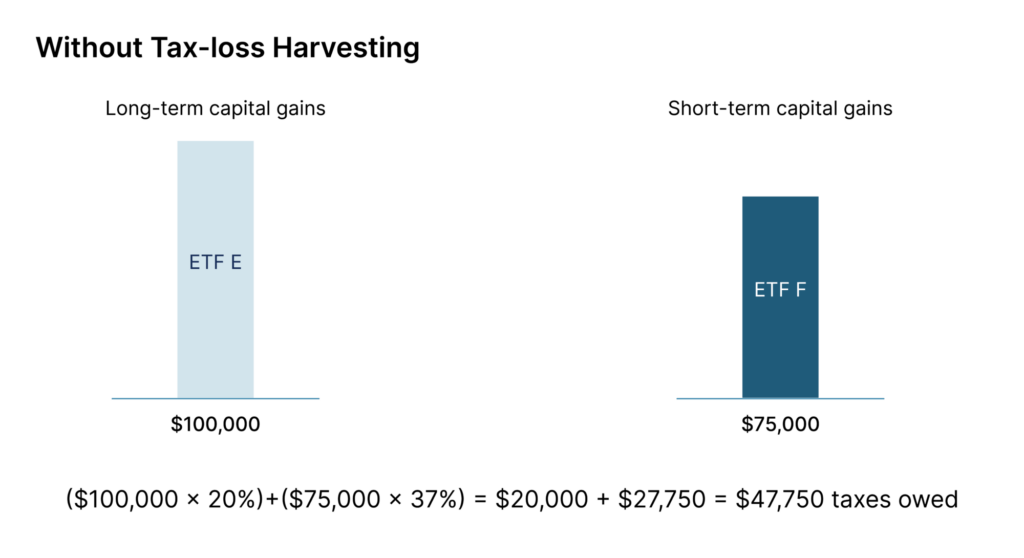

Tax without harvesting:

Formula: (Realized gain x long-term capital gains tax rate) + (Realized gain x short-term capital gains tax rate) = tax owed

The investor’s tax without harvesting would be: ($100,000 x 20%) + ($75,000 x 37%) = $20,000 + $27,750 = $47,750.

Tax owed without harvesting = $47,750

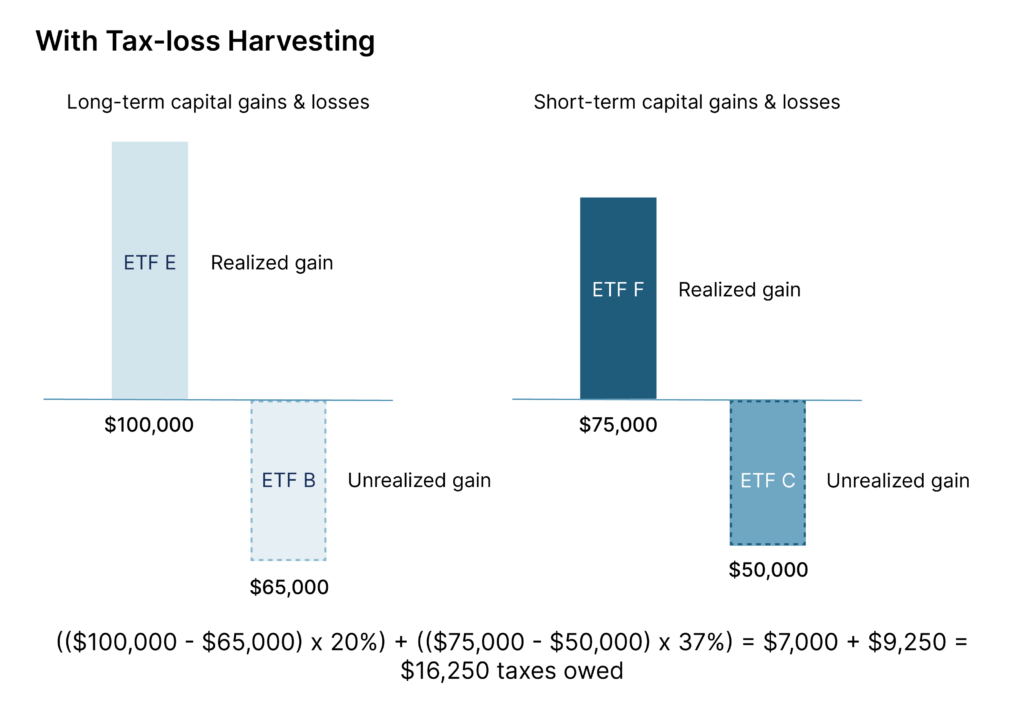

Tax with tax-loss harvesting:

Formula: (Realized gain – unrealized loss) x long-term capital gains tax rate) + (Realized gain – unrealized loss) x short-term capital gains tax rate) = tax owed

If the investor harvested losses by selling ETFs B and C, the sales would help offset the gains. The tax owed would be: ($100,000 – $65,000) x 20%) + ($75,000 – $50,000) x 37%) = $7,000 + $9,250 = $16,250.

Tax owed after tax-loss harvesting = $16,250

Now, there are always risks in investing and tax-loss harvesting. In the example above, a stock you sell could appreciate rapidly over 30 days, and you’d miss out on that the gains. The buying and selling of competitors or ETFs could also trigger short-term gains or losses that could negatively impact your portfolio or tax situation. When tax-loss harvesting, it’s important to note that short-term losses can only be used to offset short-term capital gains tax. At the same time, long-term losses can only be used to offset long-term capital gains tax.

The impact of tax-loss harvesting on your portfolio

Selling a losing asset through tax-loss harvesting can benefit your portfolio. but it also can throw off your portfolio’s balance. To reset, investors often attempt to replace the lost asset with a similar one — possibly a competitor or ETF within the industry or space. This can help maintain a diverse mix of assets and risk levels.

One important note: In order to lock in these potential tax benefits, you can’t buy back the securities you sell (or ones that are “substantially similar”) for a period of 30 days. If you buy them back before 30 days, your tax benefit is disallowed under the “wash sale” rule.

A “substantially identical security” is defined as a security issued by the same company. This could be class A shares versus Class B shares or a derivative contract issued on the same security.

However, ETFs are one way to avoid the wash sale rule. In today’s market, there are several ETFs that track the same or similar indexes. These can be used to replace one another while avoiding violating the wash sale rule. If you were to sell one S&P 500 ETF index at a loss, you could buy a different S&P 500 ETF index to harvest the capital loss.

Tax-loss harvesting isn’t useful in retirement accounts such as 401(k)s or IRAs. These are tax-deferred accounts, so you can’t deduct the losses to minimize your taxes. That said, tax-loss harvesting can be used for individual brokerage accounts and cryptocurrency assets.

Tax-loss harvesting at M1

M1 doesn’t automatically do tax-loss harvesting for you. A handful of clients have requested this feature, but we haven’t made it available. Why? Because tax-loss harvesting is considered an investment advisory decision, and M1 is a self-directed platform. So, unless you choose to edit your Pie and hit the “confirm” button, we won’t buy or sell any securities for you.

Tax-loss harvesting can be a part of your investment and tax strategy, but it should never throw off your investing goals. While it can be a great way to boost after-tax returns, it doesn’t make sense for every investor or portfolio. Consider your tax bracket, risk tolerance, your portfolio including long versus. Short-term capital gains and losses, and your personal investing strategy and goals.

Check in on your capital gains and losses in your M1 account>>

Disclosure: This article was prepared for informational purposes only and are not a recommendation of an investment strategy or to buy or sell any security in any account. They are also not research reports and are not intended to serve as the basis for any investment decision. Prior to making any investment decision, you are encouraged to consult your personal investment, legal, and tax advisors.

- Categories

- Investing

- Tags