Understanding the consequences of complex portfolios

Summary

- M1 Invest is a powerful tool, letting you automate any portfolio you want.

- Creating a complex portfolio can come with potential drawbacks. A simpler portfolio is easier to manage and can be the better investment strategy.

- Knowledge is key: know your goals, understand the platform, and use the platform to meet your goals.

We created M1 to empower you to take control of your financial life with intelligent automation and intuitive design. We know you have your own goals, risk tolerance, cash flow needs, income, perspective, and investing style. As a result, M1 Invest lets you design and manage your investment portfolio to your customized needs and wants.

This powerful tool helped our investors manage and invest more than $500 million and complete over 10 million transactions last year. The customization capabilities of our pie-based interface and fractional share investing is the calling card of M1 Invest. But as Spider-Man taught us,

With great power comes great responsibility.

You have the power to create and automate any portfolio you choose, however complex you want. Just because you can, doesn’t mean you should. Before you go and create a portfolio with 100 stocks, eight monthly scheduled deposits, and weekly rebalances, we want you to understand the potential negative consequences of a large complex portfolio.

Overdiversification

“Diversify your investments” is a common adage we hear when it comes to our investment portfolio. If diversification is good, more diversification is better, right? Well, not entirely.

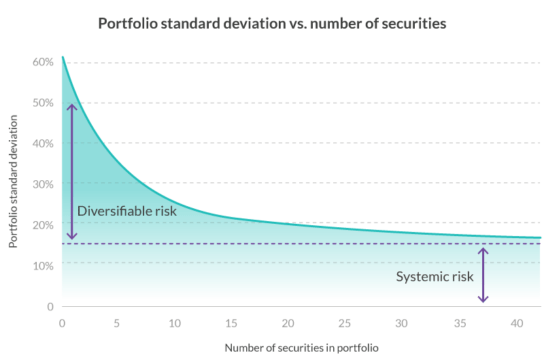

Diversification is about spreading the risk of your portfolio across multiple investments. Moving from one investment to two can maintain the same return while dramatically reducing risk, a prudent trade-off to make. The same cannot be said about moving from ninety-nine securities to one hundred. The risk spreading is negligible, and it becomes one more investment to understand, make, and manage.

The chart below demonstrates the marginal benefit to diversification for each additional stock added to a portfolio. You can see the most benefit is in the first 5 to 10 positions.

Source: Broyhill Asset Management

A widely accepted rule of thumb is that it takes around 5 to 20 different companies to diversify your stock portfolio. In his book The Intelligent Investor (1949), Benjamin Graham suggests that owning between 10 and 30 different companies will adequately diversify a stock portfolio. More than this, the diversification benefits are likely outweighed by the added complexity to your portfolio.

Churning / Overtrading

More complex portfolios come with more trades. More trades come with more costs of buying and selling securities, independent of commissions.

Yes, it’s true that M1 Finance does not charge commissions to complete trades. Yet, that does not mean that trading comes without cost. The most notable implicit trading costs come from the difference between the bid and the ask of the security (known as the spread), which is effectively lost every time a security is bought and sold.

For example: Anna buys a single share of the stock WDGT for $50 when the bid is $49.50 and the ask is $50. The next day, Anna sells her single share of WDGT for $49.75 when the bid is $49.75 and the ask is $50.25. Both the bid and the ask increased $0.25, meaning WDGT rose in value. However, Anna lost $0.25 (0.5%) because of losing the spread.

This is one of the reasons M1 advocates for long-term ownership and infrequent trading. There is a cost to trading regardless of whether you are explicitly charged.

Statements and Tax Forms

Even in the digital age, complex portfolios come with physical challenges. The number of securities owned and transactions completed in a complex portfolio can lead to monthly statements and tax forms that are hundreds of pages long.

M1 delivers all statements and forms electronically, but there will be times that the large forms and statements can become cumbersome. Providing paper statements to mortgage underwriters or tax software with maximum upload sizes will be a headache if your documents are 100+ pages long. (Also, the trees will thank you.)

SEC and TAF Fees

An explicit cost of complex portfolios and frequent trading are the fees charged by the regulatory bodies. The SEC and FINRA charge the SEC and TAF fees, respectively, on sales of securities:

SEC (Securities Exchange Commission) Fee* = total price of transaction x 20.70 / 1,000,000

TAF (Trading Activity Fee) Fee* = shares sold x 0.0001119 (with a maximum of $5.95)

*Fees are rounded up to the nearest penny

For example, if you sell ten shares of WDGT at $150 per share, you would pay a total of $0.04 in regulatory fees — $0.03 in SEC fees and $0.01 in TAF fees.

These fees are most damaging in portfolios with large number of holdings and lower overall values. The minimum cost per transaction of the SEC and TAF fee is $0.02. While this doesn’t materially affect most sales, it does if a sale value is less than $10 or even less than $1. The $0.02 can add up.

Conclusion

M1 Invest is a self-directed platform built for you to manage and automate your finances how you see fit. We do not tell you what to buy, when to buy, or how to buy, but we do want you to be knowledgeable and conscientious of your decisions when using the M1 platform.

You don’t need your financial platform to share this simple wisdom, but “knowledge is power.” We believe the best path towards meeting your financial goals is being engaged with your finances and making decisions that are best for you. We want you to know your goals, understand the platform, and utilize the platform to most efficiently meet your goals. More is not always better, and it’s intelligent to decide whether the benefits of adding an additional investment outweighs its associated cost.

- Categories

- Investing

- Tags