We just passed $1 billion in platform assets

Word-of-mouth drives capital-efficient growth

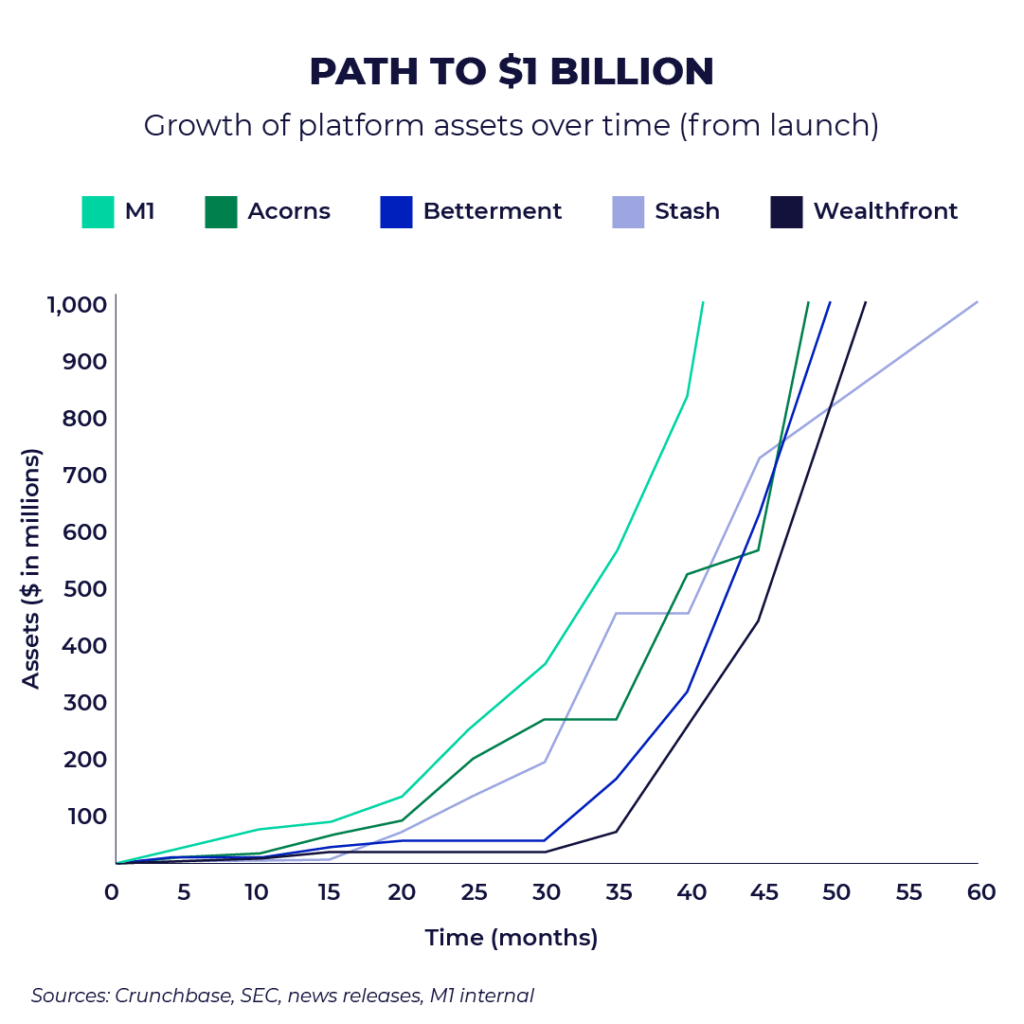

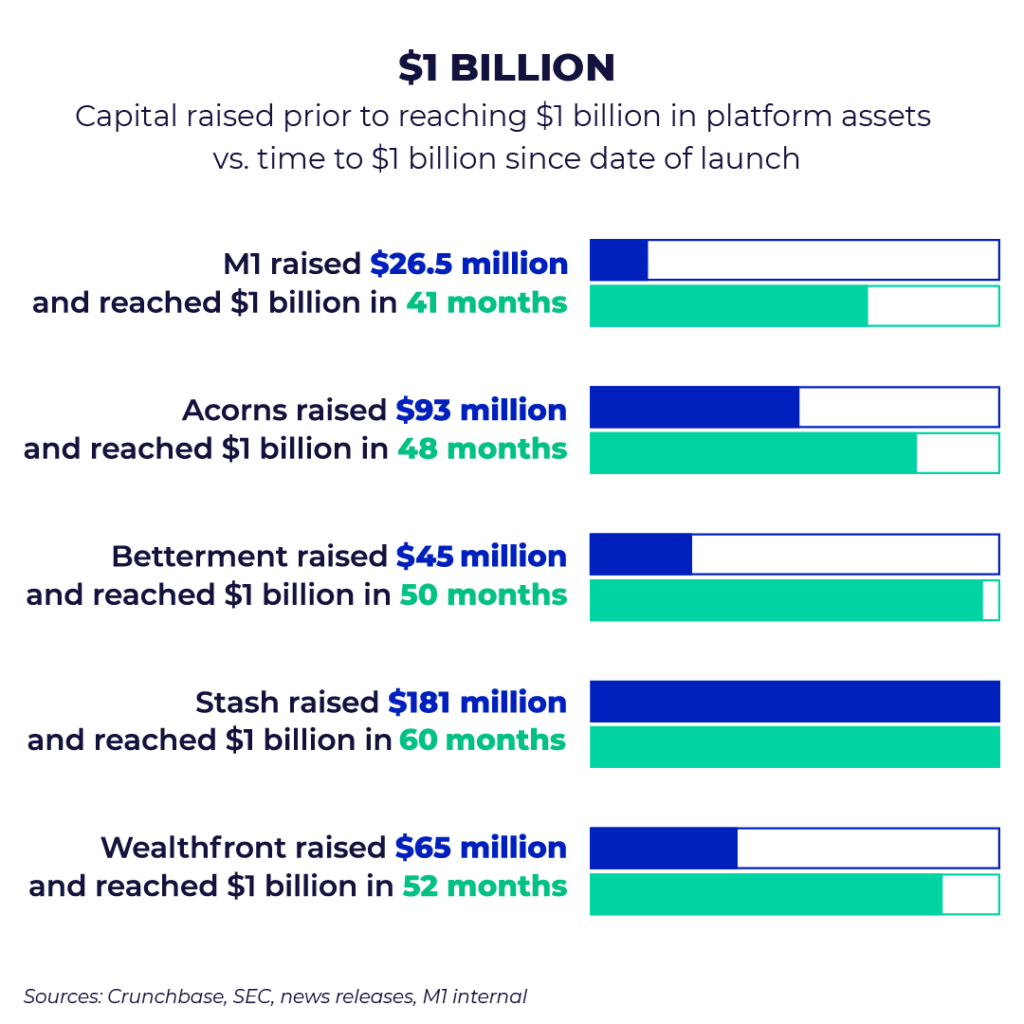

Today, we surpassed $1 billion in assets on platform. We reached this milestone in less time from launch and with less venture funding than other fintech platforms, including Wealthfront, Betterment, Stash, and Acorns.

“M1 Finance is built for the ‘engaged investor,’ someone who wants to manage their money and enjoys the convenience of an intelligent, automated, and low cost platform,” said our founder and CEO Brian Barnes. “Reaching $1 billion in assets on platform so quickly validates our vision and is a testament to our amazing team’s focus on creating the smartest money-management experience.”

Further, M1 has been capital efficient, building a free automated brokerage, a portfolio line of credit product, a digital banking experience, and reaching the $1 billion threshold, with just $26.5 million in venture funding to date:

We reached the $1 billion milestone by tripling assets managed on the platform in 2019. This pace of growth is accelerating as in January 2020 alone, M1’s assets grew by 21 percent, and it added approximately 32,000 retail brokerage accounts, more than the approximately 25,000 retail brokerage accounts E*TRADE added over the same time frame.

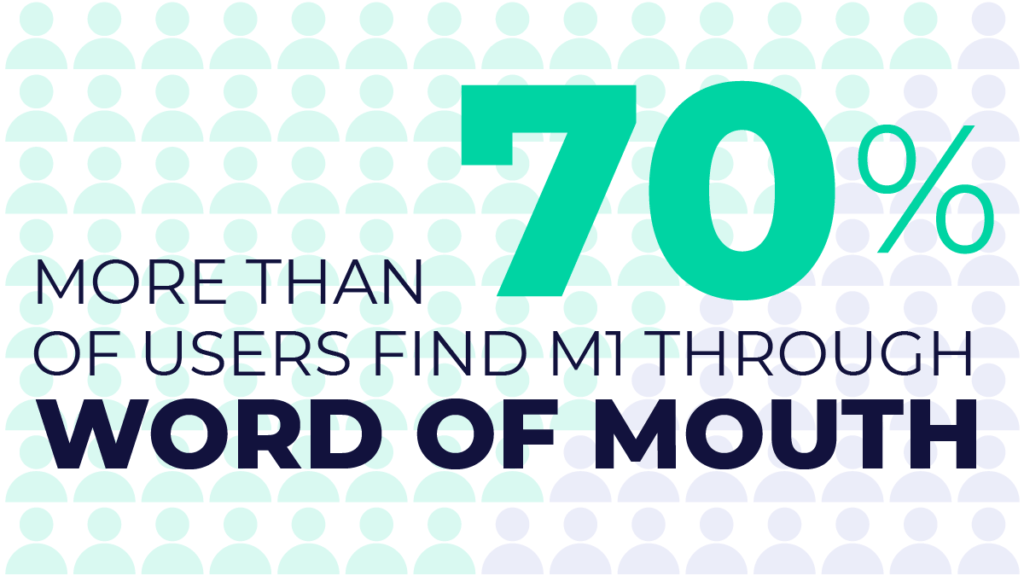

“M1 Finance’s growth, most of which is word of mouth, is evidence that there’s a huge market of people who want a next generation money management platform. M1 combines the best of digital investing, borrowing, and banking into one service that’s better than the standalone options,” added Barnes.

Since our 2016 launch, M1 has been an automated investing pioneer in a variety of areas:

A single platform for investing, borrowing, and spending

M1 is an integrated smart money-management platform for investing, borrowing, and spending.

- M1 Invest – Free, automated investing in a custom portfolio.

- M1 Borrow – Hassle-free borrowing against your portfolio with rates as low as 7.25%.

- M1 Spend – A cash-back debit card and up to 0.00% APY checking (with M1 Plus subscription), and other functionality to improve day to day finances.

Capability to transact in fractional shares

M1 Finance offers the ability to buy and sell fractional shares of stocks, allowing self-directed investors to build diversified portfolios of stocks and ETFs of their choosing regardless of how much they have to invest. For example, a portfolio of Facebook, Apple, Amazon, Netflix, Google, and Tesla can be created with as little as $100, and subsequent investments made into this portfolio for as little as $10.

Free for investors

M1 was one of the first brokerages to offer no-commission and no-management-fee investing. This market move forced the larger online brokerage to cut their unnecessary commissions in Fall of 2019.

“Our ‘Chicago-style’ approach deserves a lot of the credit for our capital efficiency,” said Barnes. “We achieved this growth by being heads down, building a fundamentally better money management experience, and relying on our users to help spread the word. We did not buy growth through massive marketing campaigns. Over the next generation, there will be trillions of dollars flowing from high-cost and outdated money management products. People will seek out the best solution and that’s exactly what we are building.”

- Categories

- M1

- Tags