What Is a Trust?

A trust is a fiduciary relationship that is created by an agreement between two consenting parties. A trustor gives a trustee the right to hold the legal title of assets that are held in the account for the benefit of one or more beneficiaries.

Why should I use a trust?

Trusts provide legal protection for the trustor’s assets and avoid probate. They ensure that the assets will be distributed according to the trustors’ wishes. They also help to minimize inheritance or estate taxes and save time and effort.

Estate planning

When you are doing estate planning, you can set up revocable and irrevocable trusts. Revocable trusts are trusts that over which you maintain control, and you can change them or terminate them at any time. Irrevocable trusts cannot be modified or terminated. Both types have benefits that will be detailed below.

According to a study that was reported by AARP, only 40% of adults in the U.S. have estate planning documents. While 81% of adults ages 72 and older do have estate planning documents such as trusts or wills, 78% of Millennials and 64% of Generation X members do not have estate planning documents.

Adults of all ages should have estate planning documents in place. They can help in the event that an unexpected illness or accident occurs so that the family members know what to do and, in some cases, help minimize taxation.

Trustee definition

A trustee is a person or organization that holds the legal title of the assets and that administers the assets or property for the benefit of the beneficiaries. They may be appointed for the administration of bankruptcy estates, charities, trusts, retirement plans, or pensions.

Trustees have a number of responsibilities. They have a fiduciary duty to act in the best interests of the beneficiaries while they administer the assets and must set aside any personal objectives or beliefs that they have. The specific duties will be dependent on the agreement and the type of assets that are held.

Responsibilities include managing all of the assets and property that are held in the trusts, including oversight of the investment accounts. They must follow general guidelines for their responsibilities and keep all of the assets safe and under the trustee’s control. They must understand the it’s terms and the beneficiaries’ wishes.

Another duty is to administer distributions to the beneficiaries as called for by the revocable trust or irrevocable trust. They are responsible for making decisions for all of the related matters based on the terms that have been outlined in the document.

Trustees are to communicate with the beneficiaries on a regular basis, and they are required to prepare statements and tax returns. Finally, trustees do not need to be attorneys and can be any person or organization chosen by the trustor.

Beneficiaries

A beneficiary is a person or entity who stands to benefit from the account through profits or distributions. In most cases, beneficiaries receive distributions. They are either specifically named or are people or organizations that meet the requirements of the trust.

You can be a beneficiary of a trust, will, or life insurance policy where there are distribution requirements. As a receiver of financial gain, you can be liable for taxes.

What is a trust fund?

A trust fund is a legal entity that holds and manages assets or property for the benefit of another person or entity, and there are many different types. In most cases, they are comprised of trustors, trustees, and beneficiaries.

The type of funds that can be set up may vary from state to state. You can use these types of funds to make certain that your wishes are followed after you die. You can also use them to protect your assets, pay for the educational expenses for your beneficiaries, transfer large sums of money and enjoy substantial tax advantages.

A trust-fund baby is simply a person who is the recipient of money from a trust. While the term is used to refer to young people who are independently wealthy and who do not need to work, many children are named as beneficiaries. These types of accounts may be set up for children so that the trustor can maintain some control over how and when the distributions will be made such as when the children reach certain milestones.

Trust accounts explained

Trust accounts are legal accounts in which funds or assets are held by a third-party trustee for the benefit of another party. The beneficiaries may be individuals or groups. The people who create these accounts are called grantors.

There are several different types of trust accounts, including the following:

- Escrow account

- Trust account

- Revocable living trust

An escrow account is a real estate trust account in which a mortgage-lending bank holds funds to be used to pay property taxes and homeowners’ insurance on behalf of the home buyer.

Trust accounts can be established for minor children who will inherit property from a will or who receive a payout from a life insurance policy. The trustee holds and manages the assets for the medical care, education and general support of the minor until he or she reaches the age of majority. At that time, he or she will receive the assets as a beneficiary.

A revocable trust is a living trust that is made during the grantor’s lifetime. The trustor is able to modify the document during his or her life. The income will be distributed to the trustor until he or she dies. At that time, it will be transferred to the beneficiaries.

Personal trust

A personal trust occurs when an individual who creates it is also the beneficiary. These are legal entities that sell, hold, buy, and manage the property for the benefit of the trustor. They are taxable entities and require separate income tax returns or are pass-through entities in which the taxes pass through as an individual income tax instead of a corporate tax.

They can be revocable or irrevocable and living or testamentary. The purposes might include the payment of educational expenses, the payment for the special needs of the beneficiaries and the minimization of estate taxes.

Revocable trust

The terms of a revocable trust can be amended, removed, or changed by the trustor. Income that is earned is distributed to the trustor. It is only after the trustor dies that the property will be transferred to the beneficiaries. A revocable trust will avoid probate if all of the assets are included. However, the assets can still be reached by creditors during the trustor’s lifetime. Finally, it will not offer any tax advantages to the trustor.

Irrevocable trust

In an irrevocable trust, the terms cannot be deleted, added to, or changed without the permission of the named beneficiaries. The property is held for the benefit of the named beneficiaries. The trustor legally removes his or her ownership rights to the assets.

The purposes of irrevocable trusts include estate, legal and tax reasons. The assets are safe from lawsuits and creditors. The tax liability is also removed on the income that is generated by the assets. They can either be living trusts, which are created and funded by individuals during their lifetimes, or testamentary trusts, which are created in wills and come into existence after the death of the creators.

Grantor trust

In a grantor trust, the creator is also the owner of its property and assets for both income and estate tax purposes. He or she will retain control over the trust’s income or assets. They are revocable since they can be changed or amended at any time as long as the trustor remains mentally competent.

Normally, the trustor will also be both the trustee and the beneficiary of the income and principal. The principal is the money or property that is held by the trustee. It is not a taxable entity. Any income is taxable to the trustor instead of the account.

The trustor will be responsible for reporting the income and taking any deductions on his or her own income tax return. This type of account will not have a tax identification number or a requirement to file its own separate tax return. A benefit is that the income can accumulate tax-free for the beneficiaries.

Non-grantor trust

This is a type of account in which the trustor has no right, interest, or title in the principal. The trustees are able to revoke or terminate them and cannot be named as beneficiaries.

Grantor trusts and intentionally defective grantor trusts change to non-grantor trusts upon the trustor’s death. It is a taxable entity that owns the assets that it holds. It will have its own tax identification number and is responsible for filing its own tax returns. It is also responsible for the income that is earned from the assets. If distributions are made to beneficiaries, the grantor trusts must issue Schedule K-1 forms so the beneficiaries can report the money on their tax returns.

Setting up a trust account

If you want to create this type of account, you will need to start by determining which type is right for you. You will then need to determine who will be the beneficiaries of it and choose a trustee. Next, you will need to determine which assets you will place in the account. If you are the trustee, you should choose someone else to serve as an alternate trustee in case something happens to you.

You will need to fill out the required paperwork and to check the filing requirements of your state. Depending on the type that you choose, you may need to get a tax identification number. It might be a good idea to seek the advice of an expert in the field such as an estate planning attorney.

Save more with M1

Trusts can offer financial benefits to people who create them. M1 Finance supports both revocable and irrevocable U.S. domestic trusts that are authorized to invest in securities.

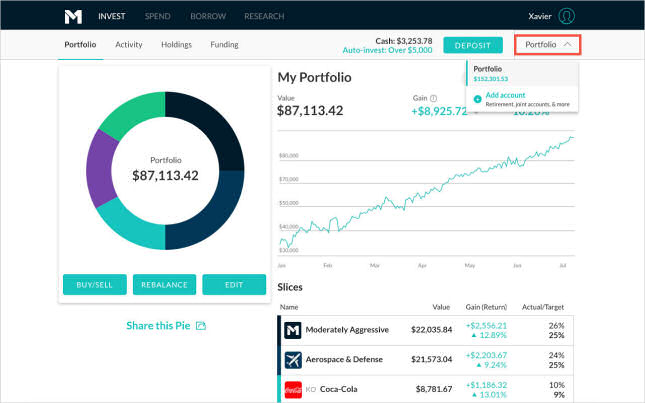

M1 Finance offers award-winning investment tools that allow your money to automatically grow while your tax burden is minimized. It uses tax efficiency tools to reduce the amount that you might owe on your taxes. M1 offers simple, secure, and free investing for do-it-yourself investors. You are able to invest without compromising, and M1 Finance empowers you to manage your money so that you can potentially earn more.

Customize your account with M1

When you open your account today, you can customize your investments according to your own needs. You can also choose among in excess of 80 model investment portfolios that have been tailored to meet different needs, time horizons and levels of risk tolerance.

The investment platform with M1 Finance is designed in such a way that investing is straightforward for everyone. You can access its automation from anywhere and at any time on your mobile device, laptop, or tablet. M1 Finance does not charge any commissions or management fees, which allows your investments to potentially grow even more.

The platform is also intuitive, saving you time by using features such as dynamic rebalancing and automated reinvestment. These features help to keep your portfolio aligned with your objectives automatically so that you do not have to constantly check and tweak your portfolio. M1 Finance uses the important principles of investing together with strong technology to make the investing process simple. This allows you to build your wealth without effort.