What is a rollover IRA and how it works

What is an IRA rollover?

An IRA rollover refers to when an investor transfers his or her money from a retirement account to a different individual retirement account. When a rollover IRA is completed correctly, money is not withheld for taxes, and a 10% early withdrawal penalty will not be assessed.

In order for a rollover to happen, possession of the funds must take place. All or a portion of the funds in the original retirement account can be moved in an IRA rollover. When you transfer your existing shares directly from a 401(k) to an IRA, the difference in the fair market value of the shares held in the account and the shares’ average cost basis is called the net unrealized appreciation or NUA.

The NUA of your shares is not subject to ordinary income tax. The NUA will be important in cases in which you are distributing shares from your 401(k) that are highly appreciated.

Why would I want a rollover IRA?

A rollover IRA tends to have either no or low fees, depending on the institution at which you open the account. It also offers continuous tax benefits. You will not owe taxes on a rollover IRA, but you will need to report it to the IRS.

A rollover IRA also offers more investment options than a 401(k). You can choose to invest your money in a variety of different securities. Finally, rolling multiple retirement accounts into a single rollover IRA allows you to track your savings more easily because you will have only one account statement.

IRA rollover average balances

According to the Employee Benefits Research Institute, the average IRA account balance is approximately $97,515 while the average total IRA account balance per person is $123,973. The average IRA rollover to a traditional IRA is $94,238 while the average contributions to a traditional IRA are $21,383.

The Investment Company Institute reports that 57% of households that have traditional IRAs have accounts that contain rollovers from employer-sponsored plans. The median IRA balance for accounts that contained rollovers was $87,500 as compared to $40,000 for accounts that did not contain rollovers.

IRA rollover rules

Investors should take the time to understand the IRA rollover rules from the IRS. Under the 60-day rollover rule, you must roll funds over from your account to a new IRA account within 60 days.

With this type of rollover IRA, the funds are paid to you in the form of a check. You then must deposit the funds that you receive within 60 days of the IRA distribution. If you do not do so, you will be assessed a 10% early withdrawal penalty if you are younger than age 59 ½.

There is also a one rollover IRA per year rule. Under this rule, you are only allowed to complete one rollover from an IRA to another IRA within a 12-month period. All of your IRAs are aggregated, including SEP IRAs, SIMPLE IRAs, traditional IRAs, and Roth IRAs and are effectively treated as one IRA.

However, the IRS reports that the one rollover per year rule does not apply to the following transfers:

- Rollovers from traditional IRAs to Roth IRAs, which are known as conversions

- Trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers

- Plan-to-IRA rollovers

- Plan-to-plan rollovers

A rollover that does not follow the one rollover per year rule is counted as an ineligible rollover. The IRS will consider it to be an excess contribution if it goes over the annual IRA contribution limit.

Under the same property rollover rule, you must roll over the same assets between retirement accounts within the 60-day period. If you do not, your 401(k) rollover will be counted as a distribution, and you may be subject to the 10% early withdrawal penalty.

To be eligible to complete a 401(k) rollover to an IRA, a distributable event must first occur. These include leaving your employer, reaching the age of 59 ½, death or becoming disabled.

You are not required to transfer the entire balance of your account to another account when you establish a rollover IRA. The money can be rolled into almost any type of IRA or retirement plan.

Taxes implications

Understanding the taxes that may be involved with rollovers is important. Rollover distributions are distributions that are paid to you from an employer-sponsored retirement plan. They have a mandatory withholding of 20% for income tax. If you want to roll your balance over and to defer taxes, you will have to add funds from other sources that are equal to the amount that is withheld.

A direct rollover is when you transfer a distribution directly to another eligible retirement plan. When you do this, the 20% mandatory withholding will not apply.

If you are younger than age 59 ½ at the time of your distribution, any taxable portion that is not rolled over may be subject to an additional 10% tax on early withdrawals unless an exception applies. The exceptions to the 10% early withdrawal penalty include the following distributions:

- To an estate or beneficiary after your death

- When you have become totally and permanently disabled

- Made as substantially equal periodic payments over your lifetime

- Medical expenses that exceed 7.5% of your gross income

- Made for an IRS levy

- Qualified reservist

According to the IRS, certain SIMPLE IRA distributions will be subject to an additional 25% tax. Refer to Publication 560 to learn more about SIMPLE IRAs and their distributions.

IRA distribution rollovers

You are allowed to roll over part or all of an eligible IRA distribution. However, there are some exceptions. You are not allowed to roll over a required minimum distribution that you must take after you reach age 70 ½. Also, you are not allowed to roll over a distribution of your excess contributions and any earnings that are related to them.

Retirement plans and rollovers

For a 401(k) rollover, you are allowed to roll over all or part of a retirement plan distribution. There are some exceptions to your ability to complete a 401(k) rollover of the following types of distributions:

- Required minimum distributions

- Loans that are treated as distributions

- Hardship distributions

- Distributions of excess contributions and related earnings

- A distribution that is one of a serious of substantially equal payments

- Withdrawals electing out of automatic contribution arrangements

- Distributions to pay for life, accident, or health insurance

- Dividends on employer securities

- S-corporation allocations that are treated as deemed distributions

401(k) to an IRA rollover

A 401(k) to a rollover IRA occurs when you transfer your 401(k) assets into a traditional or Roth IRA. There are several reasons that you might want to consider transferring your 401(k) assets to a rollover IRA.

Depending on the IRA that you choose for your rollover IRA, your assets will continue to grow on either a tax-deferred or tax-free basis. A rollover IRA provides you with more investment options. When you have a 401(k), your investment options are limited to a few mutual funds. With an IRA, you can choose between mutual funds, individual stocks, bonds, bond funds, and exchange-traded funds.

You are also able to combine several retirement accounts in your IRA, and you can buy and sell at any time. Most 401(k) plans limit the rebalancing of your account to once per year. An IRA also allows you easier access after your rollover than if you had left the funds with your former employer.

You should roll over your 401(k) when you have left your old company. It is also a good idea when you have multiple 401(k) plans with your former employers because it will be easier to track your savings if they are all contained in a single account. It is also a good idea to roll over your 401(k) when you are close to retirement.

Most people are allowed to convert their 401(k) plans to Roth IRAs. However, different plans have their own rules and requirements for 401(k) assets, so you will need to check your plan’s rules first.

Inherited IRA rollover

You can complete an inherited IRA rollover when you inherit an IRA from someone else. If you receive your spouse’s IRA after his or her death, you can roll over the assets into a brokerage account in your name and treat the assets as your own. This allows you a greater degree of control over the distributions and taxes.

If you inherit a traditional IRA from someone other than your spouse, you are not allowed to roll it over or to allow the account to receive a rollover contribution. You must follow the required minimum distribution rules and withdraw the IRA assets within a specified period of time.

Rolling over company stock to an IRA and NUA

When you want to roll over company stock to an IRA, you must follow the net unrealized appreciation or NUA rule. The net unrealized appreciation or NUA rule is a tax rule that may allow a transfer of existing shares directly to an IRA from your 401(k).

The net unrealized appreciation is the difference between the market value of the shares that are held in your tax-deferred account and their average cost basis. Many plans require that the funds are transferred as money instead of as shares to the IRA. The transfer may be permitted once you are retired or when you no longer work for the employer.

Ineligible rollovers

There are several ineligible rollovers, which generally include the nontaxable part of a distribution such as your after-tax contributions to a retirement plan. A distribution that is one of a series of substantially equal payments for your life expectancy or of the joint life expectancies of you and your beneficiaries are also ineligible to be used for a rollover.

Other ineligible rollovers include the following types:

- A required minimum distribution

- A hardship distribution

- Dividends that are paid on employer securities

- Distributions to pay for the cost of life insurance

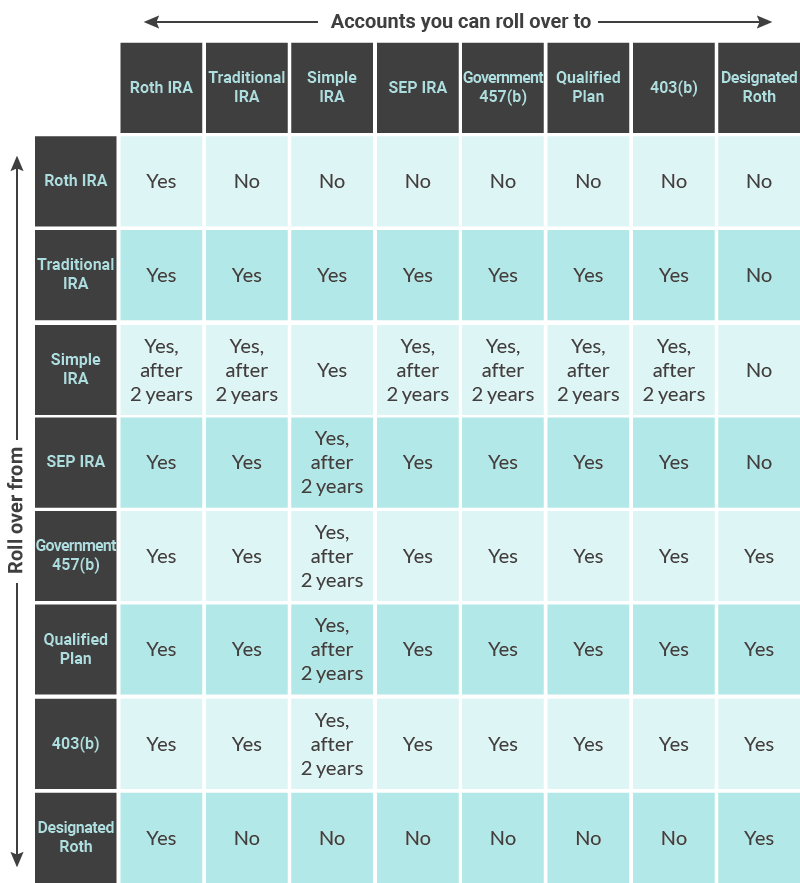

Rollover chart

Difference between a rollover and a backdoor Roth

Roth IRAs have certain requirements to make regular contributions to them. If your income is too high to make regular contributions to a Roth IRA, you can create a backdoor Roth instead to benefit from its tax-free withdrawals. A backdoor Roth is when you convert a traditional IRA to a Roth IRA, which is a way that you can make contributions to a Roth IRA if you are not otherwise eligible.

When you convert a traditional IRA to a Roth IRA, you will pay income tax on the contributions. The taxable amount that is converted is added to your income taxes, and your regular income tax rate will be applied to your total income. If you convert the traditional IRA to a Roth IRA properly, you will not have to pay the 10% early withdrawal penalty.

There are no income limits for conversions to Roth IRAs. Converting a traditional IRA to a Roth IRA is a way for taxpayers who exceed the income limits to make Roth IRA contributions to have these types of accounts. You can make a non-deductible IRA contribution and then immediately roll it over into a Roth IRA since there are not any income limits on Roth conversions.

Once you have completed a conversion, it cannot be recharacterized. A conversion to a Roth cannot be undone. If you have started taking substantially equal periodic payments from a traditional IRA, you can convert those amounts to your Roth IRA as they arrive. The payments will be taxable, but the 10% early withdrawal penalty will not apply.

You are not allowed to convert required minimum distributions to a Roth IRA. Under the pro-rata rule, the part of your rollover contribution that is tax-exempt must constitute only a pro-rata share of the total amount that is rolled over.

Steps to open a rollover IRA

To complete a rollover IRA, you can complete a direct transfer, an indirect rollover, or a trustee-to-trustee rollover. In a direct transfer, the administrator of your former employer’s 401(k) plan sends the money directly to the new financial institution. Normally, there will be paperwork that you will have to fill out with your former employer and with the receiving financial institution. You will not have custody of the money, which helps to reduce the chances that you will have to pay tax and penalties on the amount that you roll over.

An indirect rollover occurs when your previous employer sends you a check. You then have to deposit it with the financial institution that will have your rollover IRA within 60 days. If you do not, the IRS will view you as having taken a taxable distribution of the full amount, and you may have to pay penalties.

In a trustee-to-trustee transfer, the financial institution that holds your IRA makes payment directly from your IRA to another retirement plan or IRA. A trustee-to-trustee transfer occurs when you want to switch brokerage accounts or to split a large IRA into smaller accounts. Taxes will not be withheld from the amount that you transfer, and the transfer will not be subject to the one-per-year rule for IRA rollovers.

A rollover IRA can offer you benefits if you complete it correctly. M1 Finance can help you to understand the benefits of rollovers and how you can avoid making mistakes during the process.

Hassle-free rollovers with M1 Finance

M1 Finance has earned a solid reputation because of its ease of use and its combination of sound investing principles and smart technology to help your money to grow. You are able to move your IRA account to M1 Finance without paying anything on fees. You can roll over all of your current IRAs and 401(k)s for free at M1 and stop paying IRA fees.

You can forget about having to fill out reams of paperwork. M1 makes investing in your future a seamless process. We will even help you roll over your old accounts without any cost to you. Choosing M1 Finance allows you to roll over your old accounts without any hassle.

Accessible investing with M1

Opening your account at M1 Finance requires you to complete a simple online application and to choose the type of account that you want to open. After you open your account, you can pick your own securities or choose a portfolio that has already been created by an expert that is tailored to your ability to tolerate risk, the time that you have to invest, and your financial objectives and goals.

The investment platform was created in such a way that investing is made accessible to everyone. You will be able to enjoy access to its automated features at all times. Investing through M1 Finance allows you to avoid management fees and commissions so that your money might grow faster.

M1 Finance uses dynamic rebalancing and automated reinvesting, which helps your plan to remain aligned with your goals at all times. The investing process with M1 is simplified, allowing you to grow your savings without much effort.