What is ROI?

Return on investment (ROI) is a financial metric used to assess an investment’s profitability. It is one of the most commonly used metrics in finance. All kinds of assets can be measured using ROI, including business investments and real estate, as well as personal investments such as contributions to a brokerage account.

ROI defined

ROI is a financial metric, expressed as a percentage, that assesses the profitability of an investment by comparing the net profit or loss to the initial cost of the investment.

How to calculate ROI

Understanding how to calculate ROI is fundamental for any investor. ROI is a measurement of how well an investment performs in relation to its cost, so it can be expressed as a ratio or percentage.

The formula for ROI is:

ROI = Current Value of Investment – Cost of Investment / Cost of Investment

Since Current Value of Investment – Cost of Investment is your Net Profit, it can also be expressed in shorthand as this:

ROI = Net Profit / Cost of Investment

For example, consider a scenario where an investor invests $10,000 in a stock and, after a year, the investment is worth $12,000. The ROI would be:

ROI = 12,000-10,000 / 10,000 = 0.2 or 20%

Why ROI is a useful measurement

ROI is a useful measurement as it helps investors assess the success of their financial decisions. It’s a simple but powerful metric that evaluates efficiency and provides insight for future strategy.

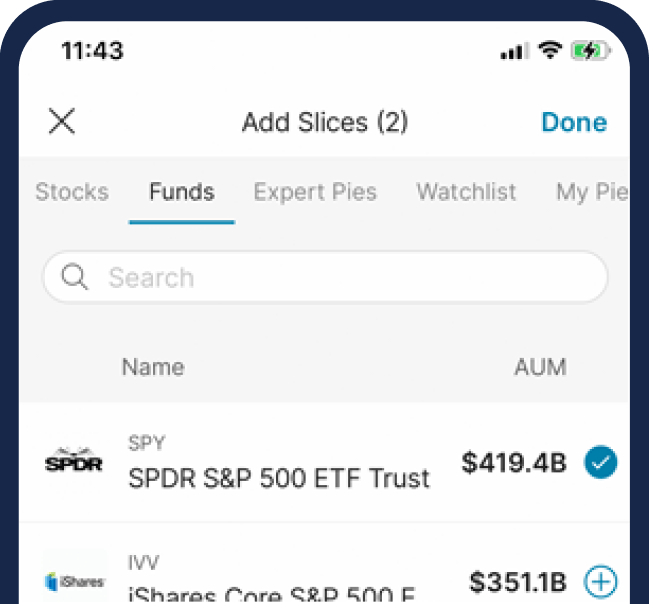

With M1’s app, you can start investing in ETFs right now by adding them to your portfolio

The limitations of ROI

The metric may oversimplify complex financial situations by not accounting for factors such as time, opportunity cost, and the inherent risks associated with investing.

ROI risk

As the potential for higher return increases, so could risk. Before making an investing decision, you should consider calculating both an investment’s ROI and its potential risk level.

How to use ROI or MWRR in your individual or retirement accounts

You can calculate ROI to see how your investments are performing. While M1 doesn’t show each securities’ ROI, it does show the money-weighted rate of return (MWRR) on the homepage.

The MWRR tracks performance based on the timing of all incoming and outgoing cash movements of a holding. So, larger deposits will have a greater impact on your overall return calculation and sells are still included in the overall portfolio performance calculation.

By using MWRR, you are able to see how your M1 Invest account has performed overall, not just recently.

The M1 bottom line

ROI can be an important metric in investing. Expressed as a percentage, ROI assesses the profitability of an investment by comparing the net profit or loss made to the initial cost of the investment. While it can be a useful measurement, ROI does come with some limitations and associated risk and it could be dependent on personal investing preferences. Calculate your ROI’s using the formula in the earlier section.

All investing involves risk, including the risk of losing the money you invest. Brokerage products and services are offered by M1 Finance LLC, Member FINRA / SIPC, and a wholly owned subsidiary of M1 Holdings, Inc.

20231219-3267591-10441523