A portfolio line of credit guide

Summary:

- A portfolio line of credit lets investors borrow against their stock portfolio at a low interest rate to make large purchases, consolidate debt, re-invest, and more.

- It’s an intelligent way to use debt because it offers low interest rates, flexible repayment terms, tax advantages, and complete spending freedom.

- This type of credit is a margin loan, which means it has the potential to amplify both gains and losses; savvy investors should be sure to weigh their risk tolerance when deciding how much to borrow.

A portfolio line of credit should be in every intelligent investor’s toolkit

The path toward wealth creation is straightforward, but by no means easy. It requires long-term discipline in several areas of your life:

- First, career discipline. Hone your skills and advance your career, so you potentially earn more than enough to cover life’s necessities.

- Then, saving discipline. Forgo immediate gratification and focus on more important life goals. You could buy a larger home, a nicer car, or more fun toys. Instead, save money for your family, your healthcare, and your personal freedom.

- Lastly, investing discipline. Be an intelligent investor who puts money to work in investments rather than letting it sit idle.

If you’ve built up an investment portfolio of any size, well done. It means you’ve done the above and sacrificed to get where you are. You’ll reap the rewards of financial independence, having the resources to do what you want to do and on your schedule.

It also means you have a powerful weapon in your arsenal. You can use your investment portfolio to optimize the other side of your balance sheet: your borrowings. Borrowing using your investments as collateral is referred to as a portfolio line of credit, a portfolio margin loan, a margin loan, or portfolio borrowing. Using this tool will let you borrow at lower rates and on more flexible terms to more easily reach your financial goals.

Improving your finances involves optimizing your borrowing

Think of your finances like a company thinks of theirs

The entire field of professional corporate finance involves analyzing and optimizing a company’s cash flows and balance sheet, consisting of their assets and liabilities. Well, personal finance is no different.

You have cash flows, consisting of your income and expenses. Then, you have a personal balance sheet. On one side are your assets, which may include things like your home, your car, your savings and investments. On the other side are your liabilities, which might include a mortgage, auto loan, or credit card bill.

Improving your finances involves optimizing all three: your cash flows, your assets, and your liabilities.

Optimize your borrowing

This guide will focus on your liabilities, or how you borrow money. Debt is a powerful tool that, when used strategically, can help you achieve your financial goals. You should not overlook debt when thinking about your money. Specifically, this guide will do a deep dive on how to borrow against your investments (aka borrow against your stocks), often called a portfolio loan, a portfolio line of credit, or a margin loan.

Borrowing against your investments is one of the best ways to borrow money. It typically has lower rates, more flexible terms, and better tax advantages than nearly every other form of borrowing. The ultra-wealthy are aware of these advantages and prioritize this type of credit.

Setting up your finances so you can tap into an investment portfolio line of credit is beneficial even if you do not use it. Doing so also increases your options should you ever decide to borrow money in the future. More options, and better options, is never a bad thing.

This guide for borrowing and a portfolio line of credit

What this guide will show you…

- Why debt is neither good nor bad, but rather a powerful strategy in your financial toolkit.

- How a portfolio line of credit or margin loans works.

- What variables to consider when borrowing money.

- Why borrowing against your portfolio is one of the best ways to borrow money.

- Why you might borrow against your portfolio to achieve various financial goals.

- The risks associated with a portfolio line of credit and ways to minimize them.

Borrowing is simply a tool. Whether it’s good or bad depends on how you use it.

Borrowing is not something to avoid

Before we dive into borrowing, we need to dispel the incorrect notion that borrowing is bad. Unfortunately, borrowing typically carries a negative connotation. Do a quick Google image search for the term “debt,” and you’ll see it portrayed as a ball and chain, a sea of bills literally drowning someone, or a ticking bomb. This depiction can be warranted, as too much debt or debt carried at a high interest rate can be financially harmful.

However, this view of debt is incomplete at best and harmful to your finances at worst. Debt can be a strong and positive force when used intelligently. It is a tool of the financially astute: financially sophisticated companies borrow, the wealthy borrow, and you too should strategically borrow.

Companies borrow

Let’s look at companies. A main responsibility of the Chief Financial Officer (CFO) and the entire finance department is to properly allocate the company’s capital. This almost always involves the use of debt. In fact, a company not using any debt is often considered financially irresponsible and a prime target for activist investors. Any CFO who refuses to borrow money on principle will find themselves out of a job.

Look no further than Apple, a money-minting machine, for an example of a financially sophisticated borrower. Apple is the most profitable company in history, the first company to reach a $1 trillion market capitalization, and has ~$250 billion in cash on hand. Yet it holds ~$100 billion of termed debt on its balance sheet.

Why, you might ask? Most of Apple’s cash is overseas and the company would be subject to taxes if it were to bring it into the United States (repatriation). Instead, Apple borrows money to pay bills, fund its dividend, and repurchase its stock. Borrowing money is less expensive than using the company’s own cash due to the tax savings.

Wealthy individuals borrow

The use of debt is the same for wealthy individuals. Many billionaires fund their lifestyles exclusively with debt. Take Larry Ellison, the founder of Oracle. He has a $10B line of credit for his spending so he never has to sell a share of the company he founded. Mark Zuckerberg, founder of Facebook, got a $6M mortgage on his home (albeit at a lower rate than everyone else can get).

Both of these individuals can easily pay for whatever they want with cash. However, that’s not always the smart thing to do. Using borrowed funds can be less expensive when compared to alternative uses of the money. And it can save money in taxes.

Almost everybody borrows

Intelligent borrowing isn’t relegated to just the wealthy companies and individuals. Most people who buy a home use a mortgage, a loan that allows them to pay for the home over time rather than all at once. Many take on student loans for college, a reasonable strategy to increase earning potential over their life. A credit card, even if paid off in full each month, is short term debt to pay for everyday goods. It’s rarer to find someone who doesn’t borrow money to manage their personal finances.

You too, should borrow (so long as you do so prudently)

Viewing debt solely as a negative ignores all its productive uses. What do you intend to use the money for? Borrowing money to buy things you cannot afford is not a good idea. Rather, borrowing can often be the more intelligent and cost-effective way to pay for things you can afford. Debt, when used responsibly and in an appropriate amount, can help you achieve your financial goals through:

- Amplifying the returns on your investments

- Deferring or reducing your taxes

- Spreading the cost of something over time

- Insuring peace of mind through a reliable source of emergency funds

Debt can be an important, and even necessary, part of a sound financial plan. The most important thing to keep in mind when you use debt is that it’s a productive tool for all levels of wealth. Too much debt can cause problems. Too little debt, and you overpay and forgo opportunity. Understand what you’re doing, what you’re hoping to achieve, and why you’re using one particular type of debt to get where you’re headed.

How a portfolio line of credit or margin loan works

Borrowing is simply paying to use money

Liability, note, debt, credit, borrowings, mortgage, loan – there’s no shortage of words for the same thing: receiving money from a third party with a promise to repay the original amount plus a bit more. The basics of any loan revolve around how much you borrow, called principal, and the amount you pay (typically expressed as a percentage of the principal per year), called interest.

While the basics are straightforward, the agreement between the lender and borrower can get more complicated quickly. How long will the funds be used? What will they be used for? What assurances can the borrower give the lender that they can afford the loan? How will the funds be repaid? What happens if the funds are not repaid? There’s no shortage of questions that need to be answered. These terms are defined prior to the lending or borrowing of money.

Because there are so many terms to be agreed upon, there’s a type of borrowing for every use case. Want a short-term loan to buy groceries? Use a credit card. Want to buy a house? Use a mortgage. Want to make improvements to that house? Use a HELOC. Want to buy a car? Use an auto loan.

Despite all of this, at the end of the day you are receiving money and paying to use it. All your money gets lumped together and becomes fungible, or interchangeable. As a result, it’s best to ignore the specific use cases of loans and look at your finances holistically. Let’s say you want to borrow $50,000 to buy a car. You should look to every borrowing source available to you, whether that’s a mortgage, HELOC, personal loan, portfolio line of credit, credit card, or auto loan, to borrow at the lowest rates and most flexible terms.

The specifics around a portfolio line of credit

A portfolio line of credit is money available for borrowing that uses an investment portfolio to collateralize, or back up, the loan. In other words, it’s a line of credit against a stock portfolio. The money is available at a moment’s notice, and you only pay for the amount you borrow. Due to the structure of a portfolio line of credit, lending risk is low and typically comes with low rates and flexible terms.

With a portfolio line of credit, you can tap into the liquidity of your portfolio without selling investments. This lets you satisfy your cash needs without disrupting your long-term investment plan or incurring tax consequences. You can self-finance large purchases at lower rates than you could get via other forms of borrowing. And it lets you prepare for the unexpected with immediate access to cash whenever a need arises.

When lending is done by a broker dealer using securities as collateral, it’s governed by Regulation T. This law lets you borrow 50% of the value to make a purchase of a security. Your portfolio’s equity then becomes the difference between the securities and the loan amount. If your equity falls below 25% of your portfolio’s value, the broker dealer is required to issue a maintenance or margin call. If you receive a maintenance or margin call, you must either deposit additional funds or sell some securities to repay some of the loan.

Borrowing against an IRA or borrowing against a 401(k)

Due to IRS regulations, no one can use a tax-advantaged retirement account like an IRA or 401(k) to collateralize a loan. Lenders who claim to offer this service are breaking federal law. In other words: you cannot borrow against your stocks if they’re in an IRA.

If you’re going to borrow money, optimize the variables of a loan

You can borrow money for a variety of purposes. Once you do borrow, you should try and get the best deal available. The deal comes down to the combination of rate you pay and the terms of the loan. To get the best deal try for the lowest rate and most flexible terms. (Hint: margin loan rates are typically among the lowest!)

Any borrowing you do is going to be some configuration of these seven variables below. Here’s how to think about each one:

1. Interest rate: lower is always better

It’s beneficial to think of the interest rate on borrowing as the cost of money. A 5% annual interest rate is simply saying, “It’ll cost you $5 to borrow $100 for a year.” Just as with all goods or services, paying less for the exact same thing is always beneficial. If all other terms of the debt are identical, pay less—e.g., choose the lower interest rate.

2. Taxes: tax deductible when you can

While the interest rate is the sticker price of a loan, you can only figure out the full cost to you after taking taxes into consideration. There are some forms of debt where you can deduct the interest payments from your taxable income. This lets you effectively lower the cost of the loan by your effective tax rate (e.g., if you’re in a 25% tax bracket, the tax-deductibility of interest lowers the after-tax cost of borrowing by 25%). Think of tax-deductible interest like a discount code at checkout—if you can use it, you should.

3. Use: general-purpose is best

A loan might stipulate what you’re able to do, and not able to do, with the funds. For example, an auto loan may be restricted to the purchase of a car. A HELOC—a Home Equity Line Of Credit—might only be used for home improvements. A general-purpose loan is money that can be used at your discretion and is preferred as it removes restrictions. You may not change how you use the funds, but the optionality is beneficial.

4. Term: ideally not defined

A loan may or may not specify when the loan must be repaid. Just like a defined-use versus general-purpose loan, flexibility is preferred for your sake. It’s better to have the freedom to pay back on your schedule, not that of the lender’s.

5. Amortization: on your schedule

Amortization refers to the distribution of loan repayments over time. This may be defined according to an amortization schedule. Mortgages, for instance, typically have a strict amortization schedule where every month for the term of the loan you pay equal installments that cover interest and principal. Over time, the portion going to paying down principal increases until the loan balance is zeroed out by the end of the term.

Conversely, a loan with no amortization schedule has no set repayment schedule. The loan simply must be repaid by the end of the term. This is the preferred format because it, once again, adds flexibility.

Nothing prohibits you from following a set amortization schedule. Or you may decide to pay more principal one month. Or skip a month. With no set amortization schedule, you have flexibility to repay the loan, without penalties, depending on your financial situation at the time. With a defined amortization schedule, any repayment flexibility may generate fines and penalties.

6. Fixed versus variable: it depends

So, which is better, a fixed interest rate or a variable interest rate loan? It depends on timing with interest rates. A fixed-rate loan will have the interest rate stay the same over its term. A variable-rate loan will move, up or down, depending on prevailing market interest rates.

If interest rates go up, fixed is better. You are locked into the same rate, which is now lower than market. However, you’re also locked into the rate if interest rates go down and may end up paying more than you should. If interest rates decrease, a variable rate is better as the interest rate on your loan will go down as well.

So, fixed versus variable depends on what happens in the future to interest rates, which is hard to predict. You must decide what is worse, a loan getting more expensive or overpaying for a loan that could have gotten cheaper. Oftentimes, people view the loan getting more expensive as the worse outcome.

As a result, people oftentimes prioritize a fixed rate loan as it insures against rising interest rates. While this is a rational perspective, you will likely pay to insure against this risk and fixed rates are typically higher than variable rates.

7. Secured versus unsecured: unsecured prevails, sort of

With a secured loan, the loan is backed by a specific asset or group of assets. If you were to default on your loan, the lender can claim ownership of the assets to repay their loan. An unsecured loan is not backed by any asset, but rather your promise and obligation to repay. If you default, the lender becomes a general creditor and cannot take ownership and liquidate an asset as easily.

This makes it seem like unsecured is preferred, which is true. But less so than you may think. A secured loan is limited to the assets that back the loan (unless you also have a personal guarantee in addition to collateralizing it with an asset). In practice, an unsecured loan has all your assets collateralizing the loan. You will not lose ownership of a specific asset, but you will likely still be forced to liquidate some asset to cover your obligation. Since a secured loan specifies what happens in the case of a default, it’s often preferred from the lender’s perspective and they’ll give you a lower rate as a result.

Why borrowing against your portfolio is one of the best ways to borrow money

With any form of borrowing, you have the cost of the loan (the interest rate and its tax deductibility) and the terms of the loan (how you may use the funds, the term, its amortization schedule, a fixed or variable rate, and whether it’s secured or unsecured). As detailed in the last section, the lowest rate and the most flexible terms are recommended.

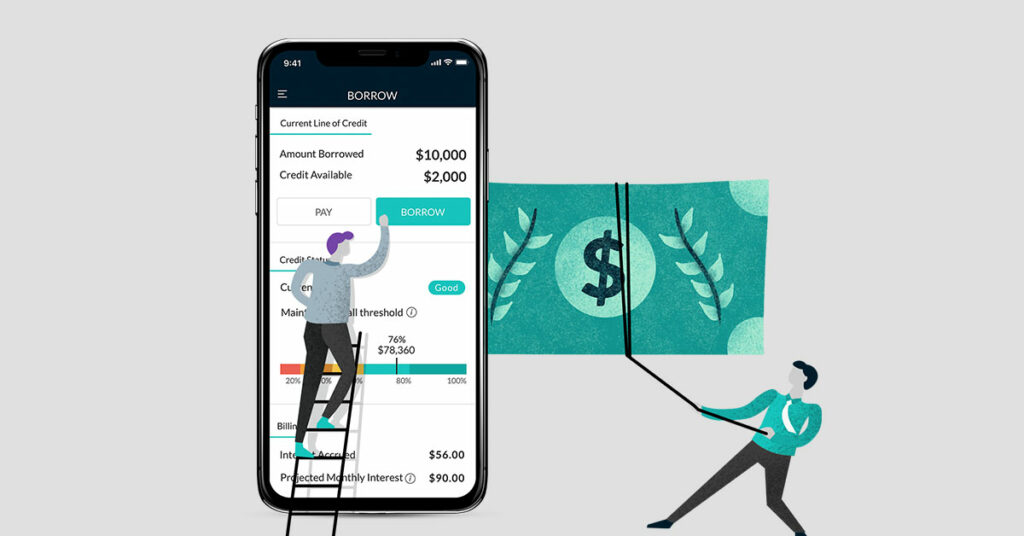

How does securities-based borrowing (aka borrowing against your investment portfolio) stack up based on the seven aspects of a loan? Extremely well, in fact. Let’s look at the cost and flexibility of a portfolio line of credit using M1 Borrow as an example:

- Interest rate: Low – M1 Borrow is currently at 8.75%, or 7.25% for M1 Plus members. This margin loan rate is one of the lowest interest rates on the market for an individual to borrow money.

- Taxes: Deductible and other tax advantages – you can deduct investment interest expenses against your investment income and defer paying taxes on unrealized gains in your investment portfolio by avoiding a sale.

- Use: General purpose – when borrowing on margin, the funds can be used however you see fit, whether that’s adding to your M1 investment portfolio or using the money off platform in everyday life.

- Term: None – when you borrow against your stocks, you can hold your loan balance for as long as you want and pay back on your schedule.

- Amortization: Undefined – just as M1 Borrow has no term, there’s no set payback schedule. You can pay back whenever it’s convenient.

- Fixed or variable: Variable – the interest rate changes with short-term interest rates. This is a negative if interest rates rise, but a benefit if interest rates fall.

- Secured or unsecured: Secured – the is a line of credit against your stock portfolio. This means if your portfolio drops in value, M1 may require you to put up additional funds or reduce your loan. This is detailed in greater depth in the risks section.

The takeaway? Across most variables, borrowing against your portfolio with M1 Borrow is as good as it gets. If you’re going to borrow money, a securities-backed loan like M1 Borrow should be the first place you consider due to all its advantages.

The strategies of debt to achieve your financial goals.

Before borrowing against your portfolio, ask yourself, “why borrow at all?” Individuals and companies who decide to borrow ask this question first, and often have a strong, rational reason to back up their answer. The argument is typically some combination of these four rationales:

- Magnify investment returns with leverage

- Reduce or defer taxes

- Spread a purchase over time

- Have the liquidity for an emergency fund while staying invested

1. Magnify investment returns with leverage

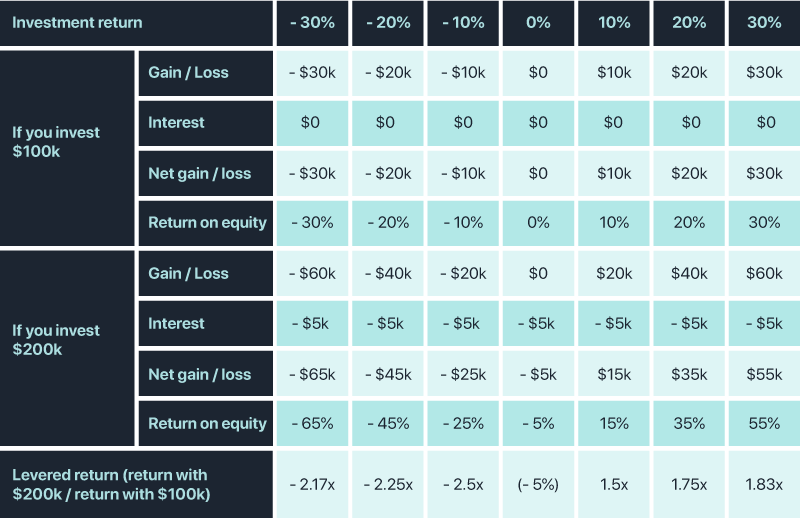

Let’s imagine you have $100k to invest. Someone offers to lend you another $100k to invest at 5% interest. Let’s look at your return potential after 1 year in this table below:

The table illustrates investment leverage. You’re able to magnify returns on your invested capital using debt. So long as your investment returns are greater than the interest rate of the debt, you’ll increase your overall investment returns. However, the flip side is also true: if your return is less than your cost of debt, you’ll increase your losses.

Many companies and wealthy individuals borrow because they believe they’ll receive a higher return from their investments than the cost of borrowing. A company may be able to pay for cost of project upfront, but the company may choose to borrow money at 5% to begin a project which it believes will return 9%. Similarly, a wealthy individual may be able to buy their home outright, but she may choose to sign a mortgage at 4% APR and put the money into investments earning 10% a year.

Other intelligent—but less wealthy—investors have a similar opportunity. They can borrow money, invest more, and magnify their returns in hopes of achieving a higher net worth quicker. The goal is the same: capture the spread between the return on your investment and the cost of your capital.

2. Reduce or defer taxes

There are two ways borrowing may help you reduce your tax bill. The first is by lowering your taxable income. The second is by deferring taxes.

- Lowering your tax bill

Your tax rate is complicated and varies based on a significant number of factors, like what’s being taxed, where you live, income level, and how long you’ve held an investment. For simplicity, let’s say your effective tax rate is 20% (which would be a relatively lower income tax rate but a higher capital gains rate).

For every dollar ($1.00) of income, you can only spend $0.80 since $0.20 must go to the government. Unless, that is, you can spend pre-tax dollars and reduce your taxable income. Every dollar of pre-tax money you spend will reduce your taxable income by a dollar, and thus reduce your taxes owed by $0.20.

This is why tax deductions are so powerful and popular. Whether it’s a standard, child, mortgage, or healthcare deduction, paying with pre-tax dollars enables you buy more and pay less in taxes.

Interest paid for investments is called investment interest expense, and you can deduct it from your investment income (so long as it’s a taxable investment) when paying taxes. If your investment interest expense exceeds your investment income, you can carry forward the expense to following years’ taxes. So long as you have investment income, which you will likely have if you have any dividends, you can reduce your taxes through borrowing money (e.g., by taking out a line of credit against your stock portfolio).

. - Deferring your taxes

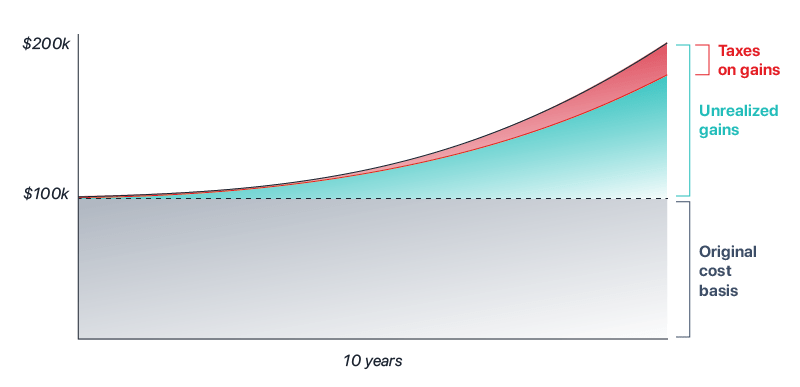

Borrowing money can also help you defer paying taxes. When you buy an investment, the price you pay is your cost basis. You will owe annual taxes on any dividends the investment pays, but you will not owe taxes on any gains until there’s a taxable event, most often a sale. When you sell an investment, you’ll owe taxes on the difference between your sale price and your cost basis (assuming it’s positive).

Borrowing against your investment lets you access the liquidity of your investment while maintaining ownership of the asset.

Tax on capital gains is often overlooked as a cost of investing. But this tax is often the most expensive part of investing, more than any commissions or management fees you’ll pay.

For example: If you’ve held the investment for less than a year, you’ll pay your income tax rate on the gains. If you’ve held the investment for more than a year, you’ll likely pay 15% or 20%, depending on your overall income (you might pay an additional 3.8% if your investment income is high enough). And this is just federal taxes. You may have to pay state taxes as well. For simplicity, let’s again take 20% as your effective tax rate.

Imagine you buy an investment for $100k and it averages a ~7% annual return. After 10 years, your investment is worth roughly double, or $200k, half of which would be your original cost basis and half would be unrealized gains. If you sell, you’ll have to pay 20% on the $100k of gains, or $20k. This is 20% of your original purchase, 20% of your gains, and 10% of your entire investment. Nowadays, a 1% management fee is excessive, yet the taxes on gains will likely dwarf this amount. The problem only increases if you’ve held the investment for longer, it continues to increase in value, and you have more unrealized gains.

Borrowing against your investment lets you access the liquidity of your investment while maintaining ownership of the asset. This lets you defer taxes on the gains until you sell the security. In our example, this lets the $20k in taxes you would have paid stay invested and continue to further compound for you. The deferral benefit comes from the gains on money that would have otherwise been paid in tax.

3. Spreading a purchase over time

If you buy anything and do not borrow money, the only option is to pay the full price all at once. Often you may have the net worth to afford a purchase, but not the liquidity. Borrowing lets you access liquidity and pay for something over time.

Let’s look at a car purchase to illustrate this point. Someone with a $250,000 portfolio might want to buy a $50,000 car. They have the money and could sell a portion of their investment portfolio to cover the cost. But they likely also have income coming in and might rather stay invested and pay for the car over time with future income. Borrowing against your portfolio lets you self-finance the purchase of the car, at lower rates than you’d receive through an auto loan (because margin loan rates are among the lowest available), and pay back over time.

This person might be investing $1,000 per month into their investment portfolio. By taking on a securities-backed line of credit (SBLOC), the person could direct that money instead toward the $50,000 car loan. They’re able to buy the car over time with future cash flow and stay invested in the securities of their choosing. The loand helps them avoid any tax consequences, as detailed above.

4. Having the liquidity for an emergency fund while staying invested

There’s a reason for the saying “cash is king.” When you have bills due, you cannot pay in stocks, a portion of your home equity, or gold. Instead, you need cold, hard cash.

Most people keep a certain amount of cash in their checking accounts for day-to-day purchases. While the cash may not earn much, it’s likely a small portion of their overall net worth so the opportunity cost is minimal.

There’s also a reason for the saying “Expect the unexpected.” Anything unexpected happening to your home, car, or health can cause bills to rack up quickly. In these scenarios, you might need immediate access to more cash than you keep on hand.

Borrowing against your portfolio is a prudent way to access to the liquidity you need at a low overall cost. The alternative is to always have enough cash on hand to pay for anything unexpected. This becomes expensive quickly as the return on cash is negligible and you’re incurring the opportunity cost of having those funds invested. Having a portfolio line of credit facility in place, such as M1 Borrow, allows you to maximize the return on your money through investing while ensuring enough liquidity for any emergency.

What are the risks associated with a portfolio line of credit and what are ways to minimize them?

The risks

All forms of borrowing involve risks. You’re required to repay the amount borrowed plus interest. If you are unable to repay, more and more of your money will go toward interest payments rather than the things you care about, your ability to borrow in the future can be negatively affected, and you may lose possession of certain property. Borrowing against your investments is no exception. Here are some risks associated with this type of borrowing:

- Your losses are magnified. When you borrow against your portfolio, you are necessarily leveraging your portfolio. This means both your gains and loses are magnified. If your investments decrease in value, your losses as a percentage of equity will be greater if you’ve borrowed money.

- Interest rates may increase. Unless you have a fixed interest rate, changes in the market interest rate will change how much you owe on the amount borrowed. If market interest rates increase, your borrowing rate will likely increase. That means you’ll owe more for the same amount borrowed.

- You’re subject to a margin call. The value of your portfolio is what’s backing the loan. If the value of your portfolio falls, there’s less available to ensure the loan will be repaid. The lender has the right, and at times is legally required, to have you either add additional funds or sell some of your portfolio to repay the loan if your portfolio drops below a certain value. While most firms will attempt to notify and work with the borrower, they are not required to and can decide to immediately sell any security at any time to repay the loan.

You can read more about margin risks here.

Minimizing your risks

With your finances, you can never remove risks entirely. Instead, you can only manage risks so they conform with your risk tolerance. There’s a risk / reward tradeoff that every intelligent investor needs to understand and make in pursuit of their financial goals. Here are ways to manage the risks associated with borrowing against your portfolio.

- Borrow less than the full amount available. The more you borrow, the higher the risks of leverage and a margin call. Borrowing 10% of your portfolio is very different than borrowing 50% of your portfolio. The latter leaves a significantly smaller buffer and your portfolio becomes more exposed if there are negative trends in the market.

- Diversify your portfolio. If you’re borrowing against a concentrated portfolio, any large negative movement in one of your securities can cause a large loss or margin call. Diversifying does not remove this risk, but it does make your portfolio less subject to the movement of any one security.

- Own less volatile securities. The requirement for a margin call is calculated on a nightly basis (sometimes intraday). If the value of a security substantially declines, you may face a margin call and be forced to liquidate the position, even if it’s likely to recover in the near term. As a result, you only want to borrow against less volatile securities.

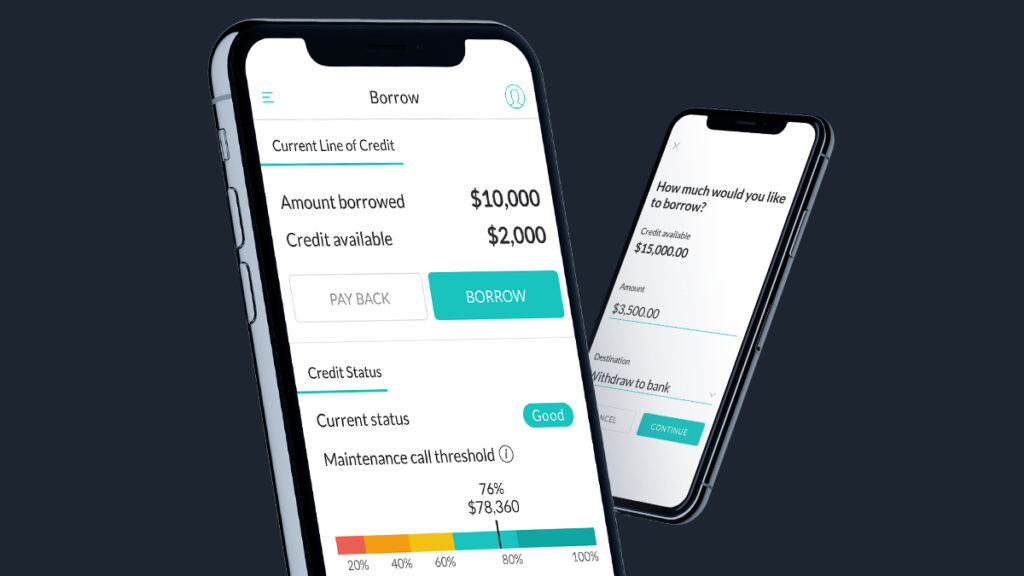

Takeaways: details on M1 Borrow

M1 Borrow makes it easy to borrow against your investment portfolio by offering…

- A competitive interest rate.

- Flexible repayment terms.

- Funds available for any use.

Because of the attractive terms it offers, M1 Borrow is an excellent source of debt for investors looking to maximize their earning potential.

To take advantage of M1 Borrow, here’s what you have to do:

- Open a margin account through M1 Finance.

- Deposit at least $10,000 into your account.

- Borrow up to 40% of the total amount of your portfolio.

- Use the money to do whatever you want: make a purchase, re-invest the funds, refinance existing debt, or whatever else gets you on track to achieve your financial goals.

- Repay the loan at your convenience.

If you’re interested in making your money work even harder, consider upgrading to an M1 Plus account. As an M1 Plus member, you’ll enjoy a discount on your margin loan rates, have the opportunity to earn interest on a checking account, earn 1% cash back through an M1 Plus Visa® debit card, and enjoy additional trading and investing options through your brokerage account.